Drop Shipments: What Makes Sales Tax So Difficult?

Understanding the sales tax implications of drop shipments is a complex and frustrating issue. Drop shipments can impact virtually any individual or company purchasing goods. So many different types of businesses use drop shipments and don’t realize the impact to their business – until they get billed tax from their supplier!

Because of the ever-changing complications that come with drop shipments, the Sales Tax Institute has received many requests for more information and clarifications. To help understand some of the main issues related to drop shipments, I’ve put together some fundamentals and FAQs to help you gain an understanding of the issues.

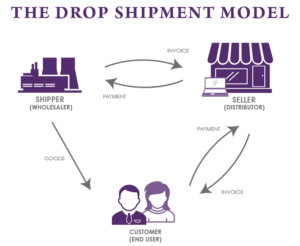

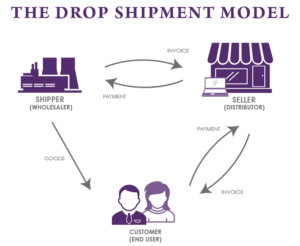

What is a drop shipment?

A drop shipment is a transaction where a retailer accepts an order from a customer, places the order with a manufacturer or supplier, and directs the manufacturer or supplier to ship the goods directly to the customer. The manufacturer/supplier then bills the retailer for the wholesale price while the retailer bills the customer the retail price.

Why do drop shipments create sales tax issues?

Sales tax is imposed on the final consumer. The retailer should be able to purchase items it sells exempt from sales tax under the resale exemption. The complications lay in understanding how the retailer claims a resale exemption for shipments to a state where it isn’t registered to collect sales tax. And when it doesn’t qualify for an exemption, which price – wholesale or retail – should be taxed? In other words, what constitutes the tax base to which sales tax applies? This is a difficult task since most wholesalers don’t set the retail mark-up of the items.

Other things to consider when examining drop shipments include nexus, what documentation is required, who is registered to collect sales tax and much more. Factor in cross-country sales, fulfillment warehouses, a growing reliance on e-commerce, and differing state legislation and it becomes tricky for not just retailers and suppliers but even for sales and use tax practitioners to sort out how drop shipments should be treated.

What is nexus?

Nexus is the determining factor for whether an out-of-state business selling products into another state is liable for collecting tax on sales in the state. It’s the sufficient presence established by a temporary or permanent presence of people or property (or as we are seeing these days other “economic” activities) which gives a state the right to require an out-of-state company to pay or collect and remit taxes. Without nexus, states cannot require out-of-state businesses to register to collect and remit sales tax.

Drop shipments can create sales tax nexus and collection issues for the involved parties in multiple ways. Click-through nexus and Affiliate nexus rules often apply in drop shipment business structures. Use of third-party agents in drop shipments is often overlooked in determining where a retailer is required to be registered. Ownership of inventory at the fulfillment house (such as under an Amazon FBA arrangement) can create nexus for a retailer by the drop shipper. Additionally, some fulfillment activities performed on behalf of the retailer may create nexus. Even if nexus isn’t created, an out-of-state retailer may be forced to register (and therefore collect tax on its sales) just to avoid paying tax to its suppliers.

Is there a solution to simplify taxing drop shipments?

Somewhat. The Streamlined Sales and Use Tax Agreement, or SST Agreement, requires all of its member states to honor drop shipment transactions as sales for resale and require wholesalers to accept alternate exemption documentation from retailers with sales or use tax permits in other states. There are 23 full member states that have adopted SST. And a number of other states also allow alternative documentation to claim the sale for resale.

Where Can I Learn More About Drop Shipments?

This is just the tip of the iceberg – if you’re looking for additional information on drop shipments, we have numerous helpful resources:

This blog post is also published on Linked In: https://www.linkedin.com/pulse/drop-shipments-what-makes-sales-tax-so-hard-diane-yetter

About the Author:

About the Author: