Three Years of South Dakota v. Wayfair: The Cost of Compliance on Businesses

This is part two of our series on how the South Dakota v. Wayfair decision has changed the landscape for businesses over the past three years. Check out the other parts of the series: major challenges and the future of nexus, marketplace nexus, local tax issues, and audit trends.

The sales tax landscape had a seismic shift on June 21, 2018. On that day, the U.S. Supreme Court released its decision in South Dakota v. Wayfair, allowing states to require remote sellers (who exceed certain economic thresholds) to collect sales tax on sales into their state.

For businesses across the country, the number of states they had nexus in ballooned as states released their economic nexus standards. A growing nexus footprint requires companies to register, collect tax, remit it to the state, and file returns – all of which necessitates having adequate technological and human resources to ensure compliance. Such resources can cost businesses serious cash.

A major concern for businesses and governments alike pre-Wayfair was the cost of compliance. Three years later, that concern remains.

To gather insight on how the Wayfair decision has affected the cost of compliance for businesses of various sizes and industries, we surveyed the Sales Tax Institute audience about their experiences. We also caught up with sales tax experts, Cameron Stearns, Executive Vice President and CFO at Mountain Rose Herbs, Jordan Goodman, SALT attorney at HMB Legal Counsel, and Diane Yetter, President and Founder of the Sales Tax Institute, to find out how their companies and clients have been affected.

Three Years of Wayfair Survey Respondents

|

Undue Burden

When the U.S. Supreme Court evaluated South Dakota v. Wayfair, the Court noted that South Dakota’s sales tax system contained “several features that appear designed to prevent discrimination against or undue burdens upon interstate commerce.” Features like the safe harbor ($100,000 or 200 transactions) and no retroactive tax collection may have been designed to limit undue burden on taxpayers, but in practice, the results for many companies have been the opposite.

As we investigated the financial burden on taxpayers to comply with post-Wayfair requirements through our survey and interviews, two main costs emerged: the cost to implement or upgrade sales tax technology systems and the cost of needing more labor hours and staff to complete requirements.

“The collecting isn’t that big of a deal, but it’s costing us a lot to comply, get documentation in place, and set up the programs. It’s a hindrance on commerce, from selling in places we’d like to because the compliance is too difficult or complex for a company of our size.” – Cameron Stearns, Mountain Rose Herbs

For some businesses, these costs are so great that they are willing to ignore certain requirements altogether. Jordan Goodman has advised clients who believe the cost of compliance for sales tax in some states is so high that they would rather wait for the state to chase them than to comply voluntarily. That, of course, comes with its own risks, and that it’s a sentiment among some businesses is concerning.

Sales Tax Technology

A major cost of compliance for companies managing multi-state sales tax requirements is purchasing and maintaining software that meets current requirements and is robust enough to grow with their business and adapt quickly to new law changes.

Cameron Stearns is the CFO of an Oregon-based company that sells into all fifty states. With home base in a no-sales tax state, Cameron’s company didn’t have a firm understanding of their nexus footprint leading up to the Wayfair decision and had to get up to speed quickly once the decision came down. This involved a multi-hundred-thousand-dollar sales tax technology project to integrate remote tax collection functionality with their custom website that was tough to stomach.

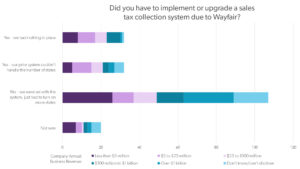

Thirty-four percent of our survey respondents either had nothing in place or had to update an existing system to manage requirements due to Wayfair. Many echoed Cameron’s experience, relaying that major post-Wayfair struggles have been related to the cost of technology. License fees, IT and programming costs, and training costs associated with the new technology can quickly overwhelm the budget of a small business – especially if you need a custom system.

Organizations like the Streamlined Sales Tax Project have attempted to limit the burden on small businesses through their Certified Service Provider (CSP) program that provides free sales and use tax technology services from certified providers including Avalara, TaxCloud, Sovos, and Accurate Tax to qualified sellers. This is a great step in the right direction, but states are going to have to take additional measures to address the cost of compliance.

Diane Yetter on the cost of compliance and Streamlined Sales Tax Project efforts.

Staffing and Labor Hours

Another cost of compliance post-Wayfair is the need for more staff and time to manage new requirements. Companies have all taken their own approach, adding additional tasks to the plates of existing employees, hiring consultants to manage certain projects like registration, outsourcing all compliance, and other variations.

“The number of overtime hours we have spent on sales and use tax over the last 3 years has been way too much. I feel the middle market companies were hit the hardest, just over the thresholds but without with the staff and technology to manage it.” – Survey Respondent

The majority of survey respondents stated they had enough in-house resources to manage new sales tax requirements. Others voiced concerns about being understaffed for the amount of work required to manage new requirements.

Wrapping Up

It’s no question that the bulk of the administrative and financial burden of collecting and remitting sales tax post-Wayfair has fallen on businesses. Numerous survey respondents voiced concerns about the lack of uniformity among economic nexus laws and the lack of government support for smaller businesses contributing to the costs they face.

“It has been a lot of extra costs added to calculate sales tax, verify calculations, report, and pay for them, compared to the actual taxes collected in some states with very low thresholds. A very frustrating experience. I wish they would standardize the system and create one rate, one return per month for all states.” – Santiago Massano, Jest Paint LLC

Coordinated and consolidated efforts by state governments, like the Streamlined Sales Tax Project, are needed to help relieve the cost of compliance for businesses. Businesses want to comply because not collecting tax is a risky and potentially even more expensive route.

In the meantime, we’re here to help. If you need help navigating economic nexus, make sure to check out the resources below. If you need personalized assistance to evaluate your obligations, we offer a Wayfair Risk Analysis that might be just the right thing for you.

Interested in the rest of the survey results? Want to be sent the rest of the Three Years of Wayfair series?Click the button below to download a PDF version of our Three Years of South Dakota v. Wayfair survey. You’ll find insight into the impact of the decision on businesses registration efforts, marketplace obligations, audit requests, software and staffing requirements. You’ll also be added to a list to be sent the final part of our Three Years of Wayfair blog series on audit trends. |