Uniformity is Needed! Key Takeaways from U.S. Senate Finance Committee Hearing on Sales Tax Post-Wayfair

Sales tax rarely makes it to the “big stage” of Capitol Hill policy hearings. However, on June 14, 2022, the U.S. Senate Finance Committee hosted a full committee hearing to examine the impact of the South Dakota v. Wayfair decision on small business and remote sellers.

The hearing was called by two senators in states without sales tax, Senator Steve Daines of Montana and Senator Maggie Hassan of New Hampshire. Witnesses for the hearing included a mix of small business owners impacted by the decision and sales tax policy experts, including our own Diane Yetter.

Significantly, the small business owners and sales tax experts were all aligned in the major talking points of the hearing: post-Wayfair rules have created challenges for businesses and uniformity of nexus rules is needed across the states. In solutions presented, no one in the hearing asked for a repeal of the Wayfair decision except for Senator Hassan.

Despite objections from non-sales tax state senators that their constituents be required by other states to collect sales tax, it’s safe to say economic nexus is here to stay. A recent Government Accountability Office (GAO) survey reported that 33 states collected around $23.1 billion in 2021 from remote sales. This number is significantly higher than original GAO estimates put forth in a pre-Wayfair report of $8 to $13 billion in revenue gains if states were given expanded authority to collect sales taxes from remote sellers. Per U.S. Census data, the increase may be partially attributed to a fast growth in e-commerce sales between 2017 and the first two quarters of 2020, which contained the onset of the COVID-19 pandemic.

All states with a sales tax have enacted economic nexus rules for remote sellers due to this immense financial incentive. Missouri’s economic nexus provisions will be effective January 1, 2023. At the four years post-Wayfair inflection point, the Senate hearing was well timed to dig into the resulting complexities for businesses and potential solutions to reduce burdens.

Post-Wayfair Economic Nexus Rules Created Challenges for Businesses

Economic nexus rules implemented across the states post-Wayfair have required businesses to navigate new and unique state by state requirements. Businesses with limited physical presence in multiple states, small businesses, and those based in non-sales tax states have experienced amplified challenges. Companies, particularly in these categories, often lacked the infrastructure to immediately comply with new requirements and had to develop new processes and implement new technologies to manage economic nexus.

Big changes like this within in a business can’t happen overnight. It can take months to upwards of a year to have everything in place to come into compliance when you’re dealing with requirements in dozens of new states—not to mention the cost.

Lack of Uniformity in Economic Nexus Rules

While there are uniform economic nexus concepts across the states, each state has implemented their own unique combination of rules that businesses must take time and care to wade through.

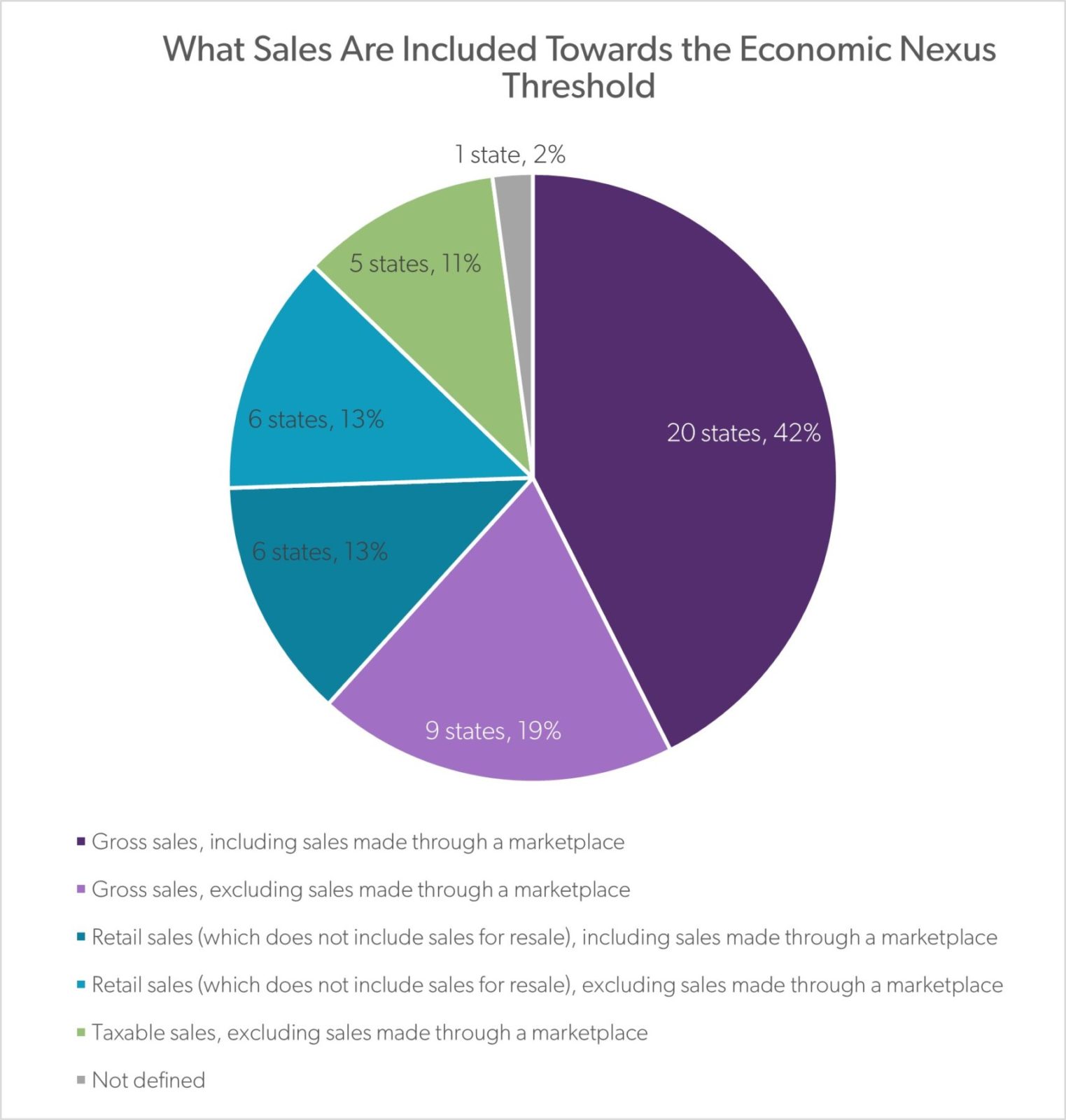

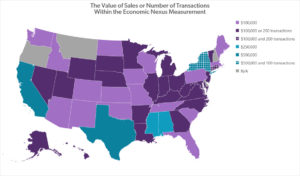

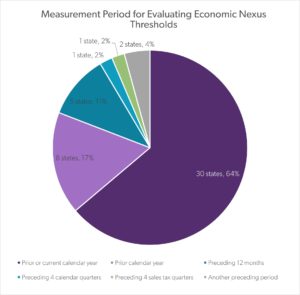

Businesses must evaluate which type of sales are included towards a state’s economic nexus thresholds (gross vs. retail vs. taxable sales) and the value of sales or number of transactions (invoices) that constitute nexus, using the specific measurement (time) period in which a threshold is evaluated and when they are required to register once they exceed a threshold.

Here are some findings from Diane Yetter’s testimony that highlight the lack of uniformity among states’ economic nexus rules.

Each of the main factors of economic nexus rules is broken down on our Economic Nexus State by State Chart.

Taxpayer Guidance Challenging to Find and Interpret

Four years post-Wayfair, all of the states with economic nexus provide at least some guidance for taxpayers on their sites. However, it is not in a consistent format or a central location and often lacks detailed descriptions of the factors of economic nexus rules described above. If businesses cannot find the information they need, let alone interpret it, how can they keep compliant?

We’ve gathered many of the key resources on economic nexus posted by each state on our State Notices & Resources for Remote Sellers page.

Efforts by the Streamlined Sales Tax Governing Board to provide guidance from its 24 member states in a clear and consistent format and in a single location should not go unnoticed. The organization has a centralized database of member state administrative practices that was recently updated to include critical information for remote sellers, marketplace sellers, and marketplace facilitators. Check out Disclosed Practice #8 of the SST Taxability Matrix: Tax Administration Practices.

“Sellers are relieved of liability if they charge and collect the incorrect amount of sales tax if they relied on erroneous data provided by an SST State on a state’s Taxability Matrix,” said hearing witness Craig Johnson, Executive Director of the Streamlined Sales Tax Governing Board, “The SSTGB publishes all the SST State’s Taxability Matrices on its website making it easy to find answers for any of the SST States.”

The High Cost of Compliance

The two small business owners who testified at the hearing attested to the increased costs faced by their business as a result of the Wayfair decision. John Hennessey, President and CEO of Littleton Coin Company, an online coin collecting retailer based in New Hampshire, stated his company incurs about $50,000 in third-party costs for an annual software licensing, registration fees, tax filing fees, accounting fees, and legal advice. The company also faces internal costs for labor, systems maintenance, and customer service related to sales tax.

Michelle Huie, founder of VIM & VIGR, an online retailer of compression legwear based in Montana, reported that she spends close to $50,000 a year in out-of-pocket technology and labor costs to comply with sales tax legislation.

For most companies, technology is necessary to manage the complexity of calculating and collecting sales tax. Certain remote sellers may qualify to use a Certified Service Provider (CSPs) approved by the Streamlined Sales Tax Governing Board that provides free sales technology services. “For a typical remote seller,” Diane Yetter said in her testimony, “this can result in about a 40 percent reduction in service costs for those registered in all states.” However, implementing sales tax technology is not a one-time-fix-all solution. It can be difficult to maintain given the landscape is always changing and difficult to integrate with existing business systems.

Another real burden to businesses is the cost of filing periodic sales tax returns. Filing frequency can vary on the state and the business’ total sales into the state. Return due dates will also differ depending on the state and the window for taxpayers to compile data from the previous period and submit returns to numerous states can be very tight. Yetter has worked with clients who sometimes file monthly returns with remittances of less than $1.00 in tax. Given it can cost $25-$50 per return to file using a paid preparer, this is a burden to profitability.

The Inside Scoop from Diane Yetter, President & Founder of Sales Tax Institute

What was it like to be invited as a witness in front of a Senate committee?I was honored and humbled to be asked to represent small businesses before the Senate Finance Committee. This has to qualify as a “bucket list” item for a sales tax professional. Of course, there was a lot of work to prepare and also a bit of anxiety. I was able to think about the key points I wanted to include in my written testimony and opening statement. But I had no idea what questions might be asked! I had some great associates help me by reviewing the written submission and talk with me about some potential questions – but there still was a bit of fear of the unknown. What was your biggest takeaway from the hearing?My biggest take away was that all of the witnesses really had the same message to the Committee –economic nexus can exist, but states have to make it easier. The myriad of rules make it very complicated and expensive to manage. Simplification could be accomplished in a number of different ways. Some of the suggestions include a flat single rate per state, more consistent rules for economic nexus and even common definitions for different items that are sold. |

Pre-Wayfair Compliance Burdens Add to Complication

As Diane Yetter explained in her testimony, the lack of uniformity and consistency among state sales tax laws creates the most significant burden on sellers. The Wayfair decision brought increased visibility to this issue as remote sellers started to decipher economic nexus rules only to discover just how diverse and complex other sales tax laws can be.

John Hennessey described the overwhelm at realizing that the 10,000 different products his company sells could be classified differently for sales tax purposes depending on the state. Michelle Huie expressed frustration at the hundreds of sales tax rates that can exist in one state depending on where you sell into and what you sell. Local tax compliance and physical presence nexus are other burdens that have only intensified post-Wayfair.

Local Tax Compliance Burdens

Local tax issues play into Huie’s concerns. Thirty-eight states have local taxes that can be combinations of county, city, and special purpose districts taxes. In some cases, intricate local physical boundaries must be understood to charge the collect sales tax rate.

Post-Wayfair efforts in “home rule” states—states that permit localities to self-administer taxes—to centralize the administration of their local taxes have not been sufficient. Sellers new to collecting in a home rule state may not realize there is separate collection and registration required with each locality and information on these requirements can be very difficult to find.

“It is my belief that based on the dicta in South Dakota v. Wayfair, any state that does not have full central administration of all levels of sales tax in the state should not qualify to enforce economic nexus standards,” Yetter stated, “and certainly individual localities have no right to force remote sellers to comply with these individual authorities and to understand the nuances of all these local authorities.”

The Outdated Physical Presence Standard

Physical presence through people or property in a state was the test for sales tax nexus pre-Wayfair. This test has not gone away following the decision, economic nexus is simply another nexus test layered on top. Even if you have very minimal sales into a state but have physical presence, you have a sales tax collection responsibility. Unfortunately, most sellers are not aware of what constitutes physical presence (especially since each state can define it differently) and can easily end up assessed by the state for uncollected sales tax due for periods that pre-date the Wayfair decision and any state’s economic nexus laws.

Physical presence also creates a risk for remote sellers who use the Fulfillment by Amazon (FBA) platform. FBA sellers often don’t know where their inventory is stored, and depending on the state, inventory in a third-party warehouse creates physical presence. Your sales may fall well below the economic nexus thresholds in a state but trigger nexus due to this transient inventory. Given the marketplaces are collecting tax on these sales, sellers are rightly frustrated. This activity creates nexus on sales that they have no responsibility for.

Actions Congress and States Can Take to Reduce Burdens on Businesses

A series of rule changes and simplification efforts have occurred following the Wayfair decision to make compliance easier for taxpayers. However, more work is needed to reduce the burdens on small businesses and remote sellers.

Address Nexus Rules

To start, uniform economic nexus rules should be adopted. Diane Yetter stated that consistency among the types of sales included towards thresholds and measurement periods, elimination of transaction count thresholds, and sufficient time to register and comply when a threshold is exceeded as steps in the right direction. Thresholds based on taxable direct sales only with registration no sooner than the first day of the second month after reaching the threshold would be particularly impactful.

Elimination of the physical presence standard for transitory and non-fixed business locations such as inventory in 3rd party fulfillment warehouses, traveling employees or agents, and potentially remote employees was also raised as something Congress could do to protect small businesses and remote sellers.

Bring Uniformity to the Entire Sales Tax Landscape

If businesses meet the requirements to comply with sales tax rules, Huie suggested the creation of a centralized clearing house for registering and paying sales tax. She also advocated that a single sales tax rate be provided for e-commerce sales to simplify calculation and reduce reliance on potentially expensive sales tax technology providers.

Hennessy spoke of protection from retroactive taxation and a minimum one-year phase in period for tax collection for any new taxes as a result of the Wayfair decision. He also proposed the dream of audits only being applied prospectively and that one audit would encompass all states. Protection from income, franchise and gross receipts taxes should be part of a solution.

To create broader uniformity among states for all types of sales tax rules, Yetter recommended that Congress incentivize all states to join the Streamlined Sales Tax Project. Benefits would include uniformity of sales tax law definitions, centralization of information, and technology subsidization (CSPs). “Reducing the burden on sellers should be states’ top priority and becoming a full member of Streamlined is the best way to accomplish this goal.”

Craig Johnson emphasized that the SST is committed to seller success and to evolvement of the organization’s goals and features to meet seller needs. “SST will continue to work with remote sellers to help them get compliant and with the entire business community to develop additional simplification and uniformity provisions as new issues arise and technology continues to evolve,” said Johnson.

Will Congress Act?

Several pieces of legislation related to sales tax, online sales, and complexity have been proposed at the federal level over the past few years. Senator Hassan pointed to the 2019-2020 Online Sales Simplicity and Small Business Relief Act as an example of recent congressional action that would have prohibited states from imposing a sales tax collection duty on a remote seller for any sale that occurred prior to the Wayfair decision.

Many of these federal bills have barely proceeded beyond an introduction, so we aren’t holding our breath. Senator Wyden, the Finance Committee Chairman, did express interest in working with the five panelists to make simplifications and find common ground. We will keep you posted if Diane is invited to further discussions!

If you’ve experienced burdens as a taxpayer post-Wayfair, what solutions would you propose? Let us know by commenting on our LinkedIn post!

Read the testimonies of all four witnesses for the hearing: Examining the Impact of South Dakota v. Wayfair on Small Businesses and Remote Sales Hearing >>