Don’t be spooked! Sales Tax on Halloween Items

Halloween is close at hand. It’s a time where many gear up to embrace and celebrate the spooky things among us, supported by many trips to the grocery store, pumpkin patch and costume shop to gather the essentials. One unexpected fright lurking beneath your Halloween purchases is sales tax – with implications to consider for consumers and retailers alike!

According to the National Retail Federation’s annual survey, consumer spending on Halloween-related items is expected to reach an all-time high of $10.14 billion, up from $8.05 billion in 2020.

With an estimated 65% of Americans expected to celebrate – comparable with pre-pandemic levels – it’s critical that retailers are prepared to get sales tax right on all of their Halloween-related items.

This is no easy feat given that the sales tax application to many of the festive products consumers purchase this time of year like candy, costumes, and beloved jack-o-lanterns varies state to state. Taxability of these products often depend on nuances in state definitions within product categories like food and clothing.

Source: NRF Holiday and Seasonal Trends: Halloween

No matter if you’re dashing to the store to pick up a pointy black hat or your favorite seasonal treat, figuring out the sales tax can be a ghoulish endeavor.

Sales Tax on Candy

Children are far from the only group of people to indulge in sweet treats on Halloween. The National Retail Federation expects the U.S. to spend around $3 billion on Halloween candy this year. That’s a lot of candy and a lot of transactions to process!

For retailers to determine the sales tax you will pay on your favorite Halloween candies will largely depend on whether candy is considered a grocery/food item in that state and if it is, whether candy will be taxed the same way as groceries.

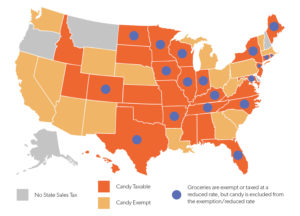

Thirty-two states and D.C. exempt groceries from their sales tax base and 6 states have a reduced rate for groceries. However, when it comes to candy, 19 of those states and D.C. exclude candy from the grocery sales tax exemption or reduced rate.

How States Apply Sales Tax to Candy

Sources: Wolters Kluwer CCH Multistate Sales Tax Smart Charts and Tax Foundation

There is some consistency in how states define candy for sales tax purposes. The 24 states that have adopted the Streamlined Sales and Use Tax Agreement agree to the following definition of “candy.”

STREAMLINED SALES TAX DEFINITION OF CANDY

“Candy” means a preparation of sugar, honey, or other natural or artificial sweeteners

in combination with chocolate, fruits, nuts or other ingredients or flavorings in the form

of bars, drops, or pieces. “Candy” shall not include any preparation containing flour and

shall require no refrigeration.

The key phrase here is that candy cannot include flour or require refrigeration. If your favorite Halloween candy is a Twix bar, score! Twix bars contain flour and may not be subject to tax since it would be considered a food item and not candy. If you are a candy seller, you need to watch your list of ingredients closely.

Diving into state definitions for food and food ingredients and how your product may be defined differently is important all year round if you sell products or make purchases in the food category.

Pumpkins: For Consumption or Decoration?

Most states follow the notion that a pumpkin is taxed as a food or food ingredient when sold in its raw state, meaning it’s not decorated or carved in any way. However, pumpkins being sold for use as decoration are taxable. Given it is almost impossible for a retailer to know how the pumpkin will be used, they can categorize it as food unless it is carved or decorated by the retailer. As a consumer, taking the time to carve or decorate your pumpkin at home will pay off in the form of sales tax savings!

If you sell pumpkins, you must pay closer attention how your role may affect taxability. Are you the grower or simply the seller? For example, Alabama provides an exemption for the sale of fruit or other agricultural products by the person or corporation that planted, cultivated, and harvested the fruit or agricultural products. Pumpkins sold by other entities are taxable.

Halloween Costumes and Sales Tax

As you go out in search of the perfect costume to don for your Halloween celebrations, whether or not you’ll pay sales tax will vary by state.

Seven states have broad sales tax exemptions for clothing, sometimes up to certain dollar amounts or with exclusions for certain things like accessories and sports clothing. To determine if your costume is included in a clothing exemption, it will take some state-by-state sleuthing.

Minnesota exempts clothing from sales tax and defines clothing as “all human wearing apparel suitable for general use” – and according to a DOR list, this includes costumes! However, the state does not include accessories in its clothing exemption, stating that costume masks sold separately from a costume are considered taxable accessories.

New York provides a sales tax exemption on clothing and footwear sold for less than $110 per item or pair. Unfortunately, anything very obviously sold as a Halloween costume does not qualify for the exemption. The New York DOR specifically calls out Halloween costumes as a taxable item. This is another instance where the create-your-own approach will pay off with sales tax savings by gathering costume elements separately.

If you start on your costume planning early, you may be able to save some money on sales tax if you reside in a state that holds a sales tax holiday earlier in the year. Many back-to-school sales tax holidays have temporary exemptions for clothing. But, as always with sales tax, it will depend on the state.

Costumes, including children’s novelty costumes are exempt during Tennessee’s annual sales tax holiday. In Texas, only children’s novelty costumes qualify for the exemption. Costume masks sold separately are also something to watch out for, for example, costumes are exempt during Arkansas’s back to school sales tax holiday, but costume masks sold separately are not.

Make Halloween Sweet Not Spooky

Looking at Halloween staples is an excellent test case of how nuanced sales tax rules can be when it comes to determining if what you sell or purchase will be taxable or not. Getting familiar with state definitions and rules is something sales tax pros must do every month of the year.

To navigate seasonal surges for certain products, take extra time to dot your I’s and cross your T’s and examine things like ingredient lists, how your product is being designed and marketed, and how your product may fall within a tax-exempt category in your state. Also take the time to ensure everything in your tax automation system is firing correctly for taxability rules and rates.

Happy Halloween! Here’s hoping your October sales tax compliance won’t be spooky!