How do Drop Shipments work for sales tax purposes?

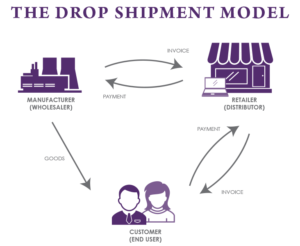

A drop shipment is a transaction where a seller accepts an order from a customer, then places the order with a third-party supplier – typically a manufacturer or wholesale distributor – and directs the manufacturer to ship the goods directly to the customer. The manufacturer/supplier bills the retailer for the wholesale price and the retailer then bills the customer the retail price. The state’s rules that must be followed and the tax that applies is the state where the goods are delivered to the customer – so the ship to state.

In the United States, sales tax is imposed on the final consumer. The retailer should be able to purchase items it sells exempt from sales tax under the resale exemption. The transaction between the seller and the customer is a retail transaction and taxed according to the nature of the goods purchased or the type of customer. The retail transaction is not between the manufacturer and the customer and therefore, the manufacturer should not be held liable to collect tax based on the retail price. The transaction between the manufacturer and the retailer is considered a resale transaction and should qualify under the resale exemption which applies in every US State.

For drop shipments when the retailer does not have nexus in and is therefore not registered to collect sales tax in the delivery state, most (but not all states) permit the manufacturer who does have nexus in the delivery state to accept alternate documentation to substantiate a sale for resale to the retailer. Otherwise, the manufacturer/supplier would be required to collect tax on its sale to the retailer even though it is really a sale for resale. Remember, exempt sales are only exempt if the right documentation is presented.

The question is then, what is the right documentation. The primary rule is a resale certificate for the ship to state issued by the retailer. However, if the retailer isn’t registered in the ship to state, can they legally issue a resale certificate for the ship to state? In most states, the answer is YES. It just depends on the state as to what they will accept. In some states, this can take the form of the home state (retailer’s state) resale certificate, while in others, the ship to state resale certificate with notations or information about the home state registration number will work. In some other states, they will accept a multi-state resale or exemption form such as the Multistate Tax Commission (MTC) exemption certificate with the home state registration number or in the Streamlined States, the Streamlined Sales Tax Exemption certificate with the home state or other registration number works. A few states will accept an affidavit of no nexus.

But there are about 10 states that are really strict and require their own registration number on their own form or the MTC form in order for a valid resale certificate to be provided. In some of these states, if the customer is an exempt entity or is also reselling the goods purchased they will accept a pass-through exemption which would require the retailer to issue their home state certificate PLUS the ship to state customer’s exemption certificate.

Drop Shipments can be really tricky and very frustrating for both retailers and suppliers. Suppliers are nervous to accept anything other than the resale certificate for the ship to state. But this will result in frustrated customers (retailers) who shouldn’t have to pay the tax. It also results in increased costs to the end customer, as they still owe the use tax if the retailer doesn’t charge them tax. And retailers generally can’t separately state the tax they might be charged by the supplier on their invoice unless they are legally registered to collect that state’s tax. What a mess – right?

Looking for more information? Check out the following resources:

- Learn more about sales tax for drop shipments with our Drop Shipments: What Are They and What’s New Post-Wayfair on-demand webinar.

- Purchase the Drop Shipments: Taxation, Compliance and Planning book by Diane Yetter, founder of the Sales Tax Institute.