Spring Into New Learning Opportunities

Here at the Sales Tax Institute, we’re always looking to teach about sales tax topics that are timely, relevant and useful for our students’ businesses and careers. With that in mind, we’re pleased to announce the line-up for our Q2 webinars.

This spring, our live webinars include a 2-part series covering some critical sales tax topics as well as a new regionally focused webinar that we are excited to be offering. Here’s the live webinar line-up for Q2:

Foolproof Automated Tax System Implementation Plan – April 26

Properly Classify Your Products & Services for Sales Tax – May 30

U.S. Regional Sales Tax Roundup – Midwest Edition – June 26

Our April and May webinars make for a great one-two punch for those looking to implement an automated tax system or to change their current system. At the Foolproof Automated Tax System Implementation Plan webinar on April 26, we’ll cover the best practices for implementing automated tax systems that I’ve picked up over the last 20-plus years assisting clients with this tricky process.

More businesses are making sales into multiple jurisdictions every day. And while expanding your company’s reach is a good thing, it can also open you up to significant compliance and audit risk in the different states where you’re making sales. And with the Supreme Court scheduled to rule on whether economic nexus is the new threshold, you’ll want to understand what you need to do if a new tax system will be required to meet a remote seller collection requirement.

That’s where an automated tax solution can help save the day. When you properly implement and maintain an automated tax system, you can ensure that your company stays sales tax compliant as well as reduce errors, save time and money, and reduce audit risk. Our April webinar will give you the keys to successfully implementing one of these systems.

Regardless of what industry you’re in, it is essential that you are properly classifying the products that you sell. Correct product classification will determine whether your sales are taxable or exempt as well as the amount of sales tax that you collect and remit on your sales. Yeah, it’s important!

So, we’ll take a deeper dive on this topic during the Properly Classify Your Products & Services for Sales Tax webinar on May 30, we’ll talk about how to properly classify your products or services for sales and use tax purposes, covering a wide range of industries. Then, I’ll show you how to implement this information into an tax system – either your own or a 3rd party tax solution.

When you’re setting up a tax calculation system, you need to make sure you classify your products correctly the first time. Not doing so could lead to major problems down the line. Our May webinar will give you the practical knowledge you can take back to your company to ensure you’re doing things right and staying compliant.

We’re presenting these 2 webinars right now because this is a critical time for many businesses to learn about these concepts. As more states enact nexus legislation for remote sellers, knowing how to not only select and implement the right tax solution but how the states classify what you buy and sell becomes very important.

By attending one or both of these webinars, you can get my expert insights into how to best evaluate, select and implement a solution and correctly classify your products for sales and use tax purposes. By putting this knowledge into action, you can help ensure that you stay sales tax compliant, save time and money and reduce costly errors. And since we think these are a great pair of courses, you can attend both for a discounted price.

In the meantime, if you’d like to get the history of tax automation and understand what has changed since the Supreme Court last ruled on sales tax nexus, download my free article that was originally published in State Tax Notes – No Excuses: Automation Advances Make Sales Tax Collection Easier for Everyone article.

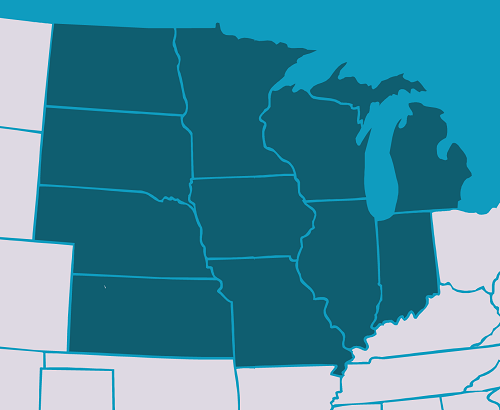

For our June webinar, I’m excited to present a new topic that I’ve been wanting to do for quite some time. Our first U.S. regional webinar will take place on June 26, when I present the U.S. Regional Sales Tax Roundup – Midwest Edition webinar.

If you have business operations in the Midwest or make sales into Midwest states, you’ll want to attend this webinar. It will cover key sales tax items and crucial updates for the following states: Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, and Wisconsin.

We all know how difficult it can be to stay on top of all the sales tax developments, legislative updates, and important court rulings. At the June webinar, I’ll teach you what you need to know regarding sales tax in these states – including important nexus developments – so you can make sure you’re staying compliant in the Midwest region.

You can visit our Sales Tax Education page for more information and to register for any of these webinars. If you have any questions about whether any of these are the right fit for you, feel free to email me back. I hope to see you at one of our webinars this spring!

About the Author:

About the Author: