South Dakota vs. Wayfair: One Year Later

June 21, 2019 marks the one year anniversary of the U.S. Supreme Court’s decision in the seminal South Dakota v. Wayfair case. And what a wild year it has been!

As you can imagine, we’ve been busy at the Sales Tax Institute keeping up with all of the latest developments across the states and educating you about what you need to know post-Wayfair. Take a look at some tools to help you stay informed, a summary of what has happened since Wayfair, and our predictions what we can expect in the future.

Resources You Need to Keep Up Post-Wayfair

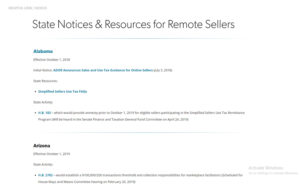

The Sales Tax Institute offers a number of free digital resources regarding remote seller legislation. We create these resources to keep tax professionals and business owners aware of the latest legislative developments as the states have responded to the Wayfair decision.

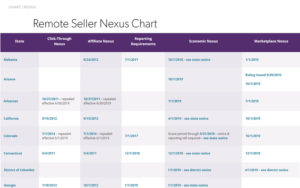

Be sure to bookmark the Remote Seller Nexus Chart. We update this on a weekly basis when states enact economic nexus and marketplace nexus legislation. Our Remote Seller Resources page is home to lots of valuable information about remote seller legislation, such as state and government resources, videos, articles, tools, charts and more.

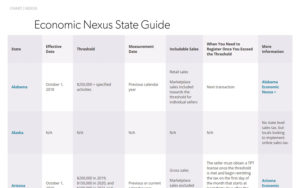

You also have an Economic Nexus State Guide available so you can find key information regarding economic nexus legislation that has been enacted across the states.

We have relished the opportunity to help so many people understand sales tax and nexus in a post-Wayfair world. We know that dealing with a development of this size is a big deal for businesses. We’ve been thrilled to see so many students and clients take control of their situations instead of bury their heads in the sand, and we’re so happy to help guide them through it.

What Have the States Done and What does the Future Hold?

The Wayfair decision was the biggest sales tax game changer to come down the line in decades. We have already felt its huge impact over the last year and will continue to for at least the next couple years. So what changes have we seen in the last year, and what can we expect to see in the next couple years?

As expected, the states didn’t waste any time enacting economic nexus legislation once they got the green light from the U.S. Supreme Court’s decision. One look at our Economic Nexus State Guide will show you that just one year after the decision, nearly every state in the U.S. has enacted economic nexus legislation.

There are only three holdouts at this point – Florida, Kansas, and Missouri – and they all proposed economic nexus legislation in 2019 but they did not succeed. We can safely expect them to get legislation enacted in the near future.

So with economic nexus legislation being enacted in nearly every state, where do the states go next? Marketplace nexus! A year ago, we predicted that many more states would enact marketplace collection responsibilities, but even we’re surprised at the speed with which the states have gone about getting it enacted.

Take a look at our Remote Seller Nexus Chart to see how many states have already enacted marketplace nexus legislation. Tax pros can expect to see this trend continue unabated over the next year or two. Will every state enact marketplace legislation? We’ll have to wait and see, but it’s probably a safe bet.

Automation Keeping Pace With Increased Demand

The Wayfair decision will continue to have a profound effect on the way that businesses operate for the foreseeable future. One area where we could see some interesting developments is with sales tax automation vendors.

With nearly every state having enacted economic nexus legislation, more and more sellers are now required to collect and remit sales tax on their sales. This could create huge opportunities for sales tax automation vendors.

Expect to see some new players hit the automation market, looking to get in on the influx of companies needing assistance automating their sales and use tax responsibilities.

Don’t be surprised if we also some price competition happening among tax automation vendors. It will be interesting to watch the future developments in this arena.

What To Do Today?

One year after the Wayfair decision, it should be abundantly clear that sellers NEED to focus on their new sales and use tax obligations. The sweeping changes that have taken place across the states mean that sellers of all stripes need to monitor their sales tax nexus and register to collect and remit sales tax as needed in the different states.

Keep using the resources mentioned above. They are a great place to start. Make sure to bookmark these pages for future reference so you can track and monitor the latest legislative developments.

But knowing how to handle your sales and use tax responsibilities correctly post-Wayfair will probably take more than that.

If you feel you need more in depth sales tax training or some personalized support to your specific business facts, we can help you with that. Sales Tax Jumpstart: Compliance, Administration and Automation Post-Wayfair is a live online course that can get you up to speed on the new sales tax landscape. We’ve had two sessions of Jumpstart already and will have another offering this fall. You can sign up to be notified when it is offered by visiting the course page. Or you may just opt for a Wayfair Risk Analysis consultation that gives you a custom report on your specific, new sales tax obligations and what to do about them.

Finally – keep an eye on our social channels (LinkedIn, Twitter and Facebook) for some fun updates about the anniversary of Wayfair throughout the week!

About the Author:

About the Author: