Three Years of South Dakota v. Wayfair: Audit Trends

This is the final part of our series on how the South Dakota v. Wayfair decision has changed the landscape for businesses over the past three years. To get caught up, check out: Part I on major challenges and the future of nexus; Part II on the cost of compliance for businesses; Part III on marketplace nexus; and Part IV on local tax issues.

The 2018 Wayfair decision created immediate and pressing obligations for companies with significant sales across large swathes of the United States. Suddenly, if your sales exceeded a state’s new economic nexus threshold, typically $100,000 or 200 sales into a state, you were required to register and begin collecting tax on your sales.

In today’s sales tax environment, the broader your nexus exposure, the higher the chance one of the states you sell into will catch wind of your business activities and send you an audit notice if they believe you have been out of compliance.

Audit risk is a post-Wayfair reality and some states have certainly been more aggressive than others in issuing notices to taxpayers. Luckily, audits are a two-way street. They are open for negotiation and a well-prepared and organized company can greatly limit the financial impact of an audit.

To find out which states have given companies the most audit trouble post-Wayfair and to gage audit negotiation success, we surveyed the Sales Tax Institute audience about their experiences. We also caught up with sales tax experts, Jordan Goodman, SALT attorney at HMB Legal Counsel, Cameron Stearns, Executive Vice President and CFO at Mountain Rose Herbs, and Diane Yetter, President and Founder of the Sales Tax Institute, to find out what they’ve seen and experienced when it comes to helping their companies and clients manage audits post-Wayfair.

Three Years of Wayfair Survey Respondents

|

Aggressive States

Audits are inevitable in the life of a business and if you’re a company with broad economic nexus exposure across the states, chances are your time may be coming. Seventy-seven percent of our survey respondents had yet to receive any notices or audit requests related to economic nexus and fifteen percent had already been so lucky.

Diane Yetter on early aggressive audit states.

Maine and Massachusetts are two states that have been aggressive from the moment the Wayfair decision came down and have been issuing notices to companies who registered late or are going after companies because of information they’ve received from third-party sources. This was consistent with our survey sample with Maine being the number one state respondents had received notices or audit requests from, and Massachusetts came in at number five.

Jordan Goodman on state approaches to getting sellers to register and audit notices his clients have received.

Audit Triggers

Jordan Goodman has begun to see inquiries coming to his clients about business activities that occurred between when a state adopted economic nexus and when the client began filing in the state. In his overall experience helping clients, most states have been reasonable in responding to client reasons for not registering as timely as the state preferred.

Cameron Stearns on her measured approach to post-Wayfair state registrations to limit liability for her company.

Going forward, if you realize you should have been registered for sales tax in a state that also has a gross receipts tax – like Ohio with their Commercial Activity Tax (CAT) or Washington Business and Occupation (B&O) Tax – you need to do your due diligence to understand your exposure. Many states with gross receipts taxes have enforcement going back many years before than Wayfair. Diane is currently helping many clients do voluntary disclosure agreements with Ohio after registering with the state as a remote seller to mitigate risk for previous CAT exposure.

Diane Yetter on the most recent audit trends she’s seeing among her clients.

Once you discover any economic nexus exposure, the more proactive you are in getting right with the state through mechanisms like a waiver request, voluntary disclosure agreement, or amnesty program, the better you can avoid hefty penalties and/or interest should the state find you first. In fact, being proactive might result in a reduction of the lookback period or a settlement on a portion of the audit liability.

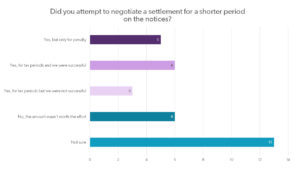

Our survey respondents have found some success negotiating a settlement for a shorter time period and for abatement of penalties. However, many found the amount wasn’t worth the effort.

Wrapping Up

While economic nexus has potentially upped the possibility that your company will receive an audit notice, you can’t let the stress of a potential audit get the best of you. With solid preparation and practices in place ahead of time, there is no need to feel defenseless and tense about audits. It’s all about your outlook.

One of our survey respondents credits the Wayfair decision for motivating their company to tighten up their compliance processes to ensure they have all their bases covered should an audit notice appear.

_____________________________________________________________________________________

“We were already registered in all 50 states. From an audit perspective, we are quicker to ensure we

have exemption certificates in place and no longer just accept that they have no nexus. So, Wayfair

has just drawn our attention to shoring up the process to ensure we are compliant in all aspects.” –

Survey Respondent

_____________________________________________________________________________________

If you need assistance navigating and defending an audit to ensure the best possible outcome for your company, the consulting side of our business provides sales and use audit defense services. We’d be honored to help you.

We also offer a Wayfair Risk Analysis that provides a personalized analysis of your economic nexus exposure so you can get caught up on your post-Wayfair tax obligations as soon as possible limit audit risk.