Three Years of South Dakota v. Wayfair: Marketplace Nexus

This is part three of our series on how the South Dakota v. Wayfair decision has changed the landscape for businesses over the past three years. Check out the other parts of the series: major challenges and the future of nexus, cost of compliance, local tax issues, and audit trends.

The second wave of sales tax nexus legislation following the 2018 Wayfair decision was marketplace nexus or marketplace facilitator collection legislation.

In simple terms, this type of legislation requires an online marketplace facilitator or provider, such as Amazon, Etsy, or eBay, to collect sales tax on behalf of its sellers if the sales it facilitates or makes on its own behalf exceed the state’s economic nexus threshold.

How has marketplace nexus impacted the businesses that sell on marketplaces? To find out, we surveyed the Sales Tax Institute audience about their experiences. We also caught up with sales tax experts, Jordan Goodman, SALT attorney at HMB Legal Counsel, Rochelle Friedman Walk, M&A attorney at Aegis Law, Cameron Stearns, Executive Vice President and CFO at Mountain Rose Herbs, and Diane Yetter, President and Founder of the Sales Tax Institute, to find out how their companies and clients have been affected.

Three Years of Wayfair Survey Respondents

|

The Second Post-Wayfair Wave

The speed at which marketplace facilitator laws made their way into state laws following economic nexus surprised several of our experts. Momentum began building in 2019 and today, every state with an economic nexus standard for remote sellers also has nexus laws for marketplace facilitators.

“eBay was great in that they were ahead of the curve on paying tax on our behalf, the nightmare was that it was a state-by-state arrangement, and we could have one sale that we need to collect sales tax on while the next one we wouldn’t!” – Jeff Miller, McGrew Equipment Company

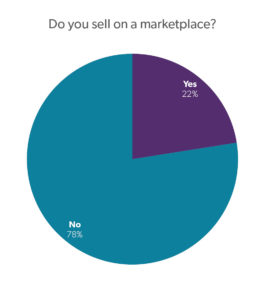

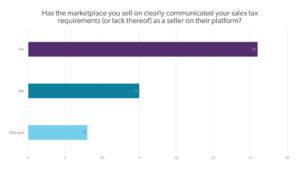

Marketplace facilitator laws are designed to limit the tax collection burden on small sellers by obligating the marketplace facilitator to collect and remit tax on behalf of all its sellers. Part of the obligation for marketplace facilitators in most states is clear communication with their sellers about their collection responsibility. Twenty-two percent of our survey respondents sell on a marketplace such as Amazon, eBay, or Etsy, and for the most part, survey respondents had received clear communication from their facilitator about their tax obligations as marketplace sellers.

Parsing Out Facilitator and Seller Requirements

Marketplace nexus laws are not uniform across the states. However, one consistency is that most states clearly lay out the obligations for facilitators, but requirements and next steps for marketplace sellers can be vague or missing altogether.

For example, if you sell 100% on a marketplace and were registered in a state before a marketplace facilitator was collecting on your behalf, can you cancel your sales tax registration? In some states, yes, you can cancel. Other states take the approach that 100% marketplace sellers need to be registered but have specialized instructions when it comes to registering and filling out returns. And still others have yet to commit on such an issue at all.

Another key requirement marketplace sellers need to watch for on a state-by-state basis is whether sales made through a marketplace are included in the seller’s individual economic nexus threshold calculation if sales are also made through other channels, like the marketplace seller’s own website. Most states require you to include marketplace sales towards the threshold calculation – even if the marketplace facilitator is collecting tax on those sales – if you also sell direct to customers using other means. You can see a state-by-state breakdown of this requirement on our Economic Nexus State Guide.

Diane Yetter on who is considered a marketplace and what is to come for marketplace nexus

The Next Phase: What is considered a marketplace?

When marketplace facilitator legislation first started being introduced, the most obvious examples of marketplace facilitators were ones that operate platforms that sell tangible goods like Amazon and eBay. However, states are catching up with the technological reality of the day and clarifying which types of businesses are considered marketplace facilitators and which types of taxes they must collect.

In many states, specialized taxes like meals, liquor, amusement, lodging, and local taxes now fall under the marketplace nexus umbrella. Marketplace facilitators can be held responsible for the collection and remittance for these taxes depending on their business. You may not realize that ridesharing companies like Uber and Lyft, food delivery companies like DoorDash and Grubhub, and short-term lodging rental companies like Airbnb and Vrbo may all meet the classification of “marketplace facilitator” in various states.

With the concept of marketplace facilitation in place, Diane Yetter believes states will look for other situations that align with the marketplace model where they can streamline tax remittance. When the marketplace facilitator is responsible for collecting tax, it’s fewer registrations and returns for the state to process.

Don’t forget! Marketplace facilitator laws do not just apply in the digital realm, nearly all of the states’ marketplace nexus laws include language that applies to in-person marketplaces. This can create obligations for physical marketplaces like flea markets and craft fairs.

Wrapping Up

If you’re just starting to get a handle on marketplace nexus requirements for yourself or even a client, take it slow. Break down each state requirement a piece at time, then start putting them together to see your bigger picture of sales tax compliance.

For a handy chart to help you understand each state’s economic nexus rules and how marketplace sales fit into the threshold calculation, check out our Economic Nexus State Guide. For a broader look at which states have other types of remote seller nexus, including marketplace facilitator rules, visit our Remote Seller Nexus Chart.

The Streamlined Sales Tax State and Local Advisory Committee (SLAC) Marketplace Workgroup with input from the Business Advisory Committee (BAC) has developed charts for marketplace sellers and marketplace facilitators related to the compliance provisions that cover the Streamlined states. Additional work is ongoing to develop Disclosed Practices on some of the more nuanced rules.

Finally, if you need personalized assistance navigating requirements for marketplace facilitators or sellers in light of marketplace and economic nexus, we offer a Wayfair Risk Analysis that might be just the right thing for you.

Interested in the rest of the survey results? Want to be sent the rest of the Three Years of Wayfair series?Click the button below to download a PDF version of our Three Years of South Dakota v. Wayfair survey. You’ll find insight into the impact of the decision on businesses registration efforts, marketplace obligations, audit requests, software and staffing requirements. You’ll also be added to a list to be sent the final of our Three Years of Wayfair blog series on audit trends. |