Three Years of South Dakota v. Wayfair

This is part one of our series on how the South Dakota v. Wayfair decision has changed the landscape for businesses over the past three years. Check out the other parts of the series: cost of compliance, marketplace nexus, local tax issues, and audit trends.

On June 21, 2018, the U.S. Supreme Court released its fateful decision in South Dakota v. Wayfair. The Wayfair decision upended decades of the physical presence standard for remote sellers for sales tax nexus and allowed states to require remote sellers (who exceed certain economic thresholds) to collect sales tax on sales into their state.

The decision was monumental in the sales tax world to say the least. Three years later, the novelty has worn off but the impact on businesses of all sizes, industries, and locations is still going strong.

To understand how the sales tax obligations of companies across the company changed due to the Wayfair decision, we surveyed the Sales Tax Institute audience about their experiences. We also caught up with four sales tax experts, Jordan Goodman, SALT attorney at HMB Legal Counsel, Rochelle Friedman Walk, M&A attorney at Aegis Law, Cameron Stearns, Executive Vice President and CFO at Mountain Rose Herbs, and Diane Yetter, President and Founder of the Sales Tax Institute, to find out the major challenges for businesses and predictions for the future of nexus.

Three Years of Wayfair Survey Respondents

|

Where We’re at in the Wayfair “Timeline”

You can think about the rollout timeline of Wayfair legislation in a couple of ways. In terms of state adoption of economic nexus laws, there is almost 100% participation. The three holdout states up until this year, Florida, Kansas, and Missouri, have all passed legislation. Missouri will continue to be an outlier until the governor signs the legislation and the legislation will not be effective until 2023.

In terms of business awareness and compliance, Diane Yetter thinks we are still fairly early in the rollout. “If this were baseball, my gut says we’re still in about the fourth inning.” Mid-sized e-commerce businesses that already had some type of sales tax system in place prior to the Wayfair decision were able to take action and register in new states quicker than other business types. The same applied to some of the largest businesses in the U.S. that had robust systems in place that made incorporating additional state sales tax requirements easier.

For small e-commerce sellers that strictly sell on marketplaces like Amazon, the broadening adoption of marketplace facilitator laws across the states has meant that these small sellers have been able to skirt compliance obligations that the marketplace is now managing for them. But for those that were attempting to be compliant early on, the challenges with filing returns with little to no tax continues as many states are not allowing them to deregister.

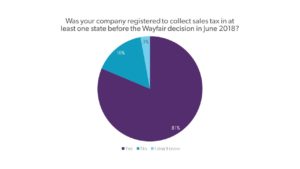

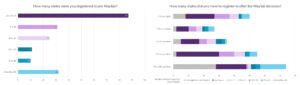

Prior to the Wayfair decision, forty-four percent of our survey respondents were only registered in five states or less. Respondents that didn’t have to register in additional states post-Wayfair were primarily already registered in 40+ states or were small sellers with registrations in five states or less pre-Wayfair. However, most surveyed businesses faced growing registration requirements.

Who has yet to address new post-Wayfair requirements? Diane believes Business to business (B2B) sellers and service businesses are two suspects sitting on the sidelines because they don’t believe (or realize!) economic nexus applies to them. A lot of the hub bub with the Wayfair decision has surrounded “traditional” e-commerce sellers. What B2B sellers and service businesses may not realize is that economic nexus requirements do not distinguish between business types. If you make a sale remotely into another state with no physical presence in that state, that state’s economic nexus legislation is typically going to apply to you.

Jordan Goodman on whether businesses are up to speed post-Wayfair.

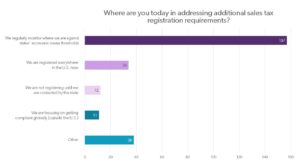

As we enter the fourth year of the Wayfair rollout, companies aware of their business footprint are closely monitoring their activities for sales tax purposes. Survey respondents keep a close eye on how their sales compare with state economic nexus thresholds and continue to work through registrations with new states.

Challenges Managing Economic Nexus

Each state has its own variation of economic nexus rules in terms of the economic thresholds set, the types of sales (gross vs. retail vs. taxable) that are included towards those thresholds, the lookback period, and many other variables that add complexity for sellers trying to navigate these rules.

States not only have inconsistency among key definitions but have also changed their stances over time, such as dropping a transaction threshold or switching sourcing rules for remote sellers. It’s been a struggle, particularly for small businesses, to get their bearings in this new sales tax landscape prone to changes. Businesses have had to invest significant research time into the obligations for each state and still may not find the clarity they need from state laws or Department of Revenue guidance depending on their industry or the types of sales they make.

“It’s so confusing and took many hours to figure out what to do with each state for each of our clients. I am still so nervous that we have missed something or are misinterpreting each state’s requirements. This HAS to be made easier for everyone to stay in compliance.” – Kerrie Kuderko, HTA, LLC

Jordan Goodman sees a lot of confusion arising among his clients whose sales fall on the “borderlines” of economic nexus, fluctuating above and below the thresholds. This primarily affects smaller sellers whose sales may be inconsistent month to month, perhaps with one large sale that pushes them over a state’s threshold. Once you exceed a threshold, you have an obligation to register and collect tax. Because the energy and resources put towards taking those steps can be steep, Jordan advises, “If you start collecting and remitting, you can’t stop. Despite the fact that you may fall below the thresholds at some point, you’re buying into this

| State | Effective Date | Threshold | Measurement Date | Includable Sales (Gross, Retail, or Taxable) | When You Need to Register Once You Exceed the Threshold | More Information |

|---|---|---|---|---|---|---|

| Alabama | October 1, 2018 |

$250,000 + specified activities |

Previous calendar year |

Retail sales Marketplace sales excluded from the threshold for individual sellers |

January 1 following the year the threshold is exceeded |

|

| Alaska | The Alaska Remote Seller Sales Tax Commission passed its “Remote Seller Sales Tax Code & Common Definitions” that would apply to local municipalities in Alaska that choose to adopt it. See our news update for the full list of municipalities that have adopted the code. |

Per Remote Seller Sales Tax Code & Common Definitions: $100,000 or 200 transactions |

Per Remote Seller Sales Tax Code & Common Definitions: Previous calendar year |

Per Remote Seller Sales Tax Code & Common Definitions: Gross sales Marketplace sales included towards the threshold for individual sellers. |

The first day of the month following 30 days from adoption by the city or borough |

Alaska Remote Seller Sales Tax Commission Economic Nexus Rules > |

| Arizona | October 1, 2019 |

$200,000 in 2019; $150,000 in 2020; and $100,000 in 2021 and thereafter |

Previous or current calendar year |

Gross sales Marketplace sales excluded from the threshold for individual sellers |

The seller must obtain a TPT license once the threshold is met and begin remitting the tax on the first day of the month that starts at least thirty days after the threshold is met for the remaining of the current year and the next calendar year. |

|

| Arkansas | July 1, 2019 |

$100,000 or 200 or more separate transactions |

Previous or current calendar year |

Taxable sales Marketplace sales excluded from the threshold for individual sellers |

Next Transaction after meeting the threshold |

|

| California | April 1, 2019 |

$500,000* *California enacted legislation that raised the sales threshold and removed the number of transactions threshold on April 25, 2019. |

Preceding or current calendar year |

Gross sales of tangible personal property Marketplace sales included towards the threshold for individual sellers |

The day you exceed the threshold |

California has limited the lookback period for certain marketplace sellers with uncollected taxes when inventory was stored in the state, for more information, visit our news item > |

| Colorado | December 1, 2018 with grace period through May 31, 2019* *If not registered as of December 1, 2018, subject to notice and reporting |

$100,000* *Colorado removed its 200 transactions threshold by permanent rules, effective April 14, 2019. |

Previous or current calendar year |

Retail sales Marketplace sales excluded from the threshold for individual sellers |

The first day of the month after the ninetieth day the retailer made retail sales in the current calendar year that exceed $100,000 |

|

| Connecticut | December 1, 2018 |

$250,000 and 200 transactions $100,000 and 200 transactions – applicable to sales on or after July 1, 2019* *Connecticut lowered its dollar threshold from $250,000 to $100,000, keeping the number of transactions the same, effective July 1, 2019. |

12-month period ending on September 30 |

Retail sales Marketplace sales included towards the threshold for individual sellers |

October 1 of the year in which you cross the threshold on September 30 |

|

| Delaware | N/A |

N/A |

N/A |

N/A |

N/A |

No sales tax |

| District of Columbia | January 1, 2019 |

$100,000 or 200 or more separate retail sales |

Previous or current calendar year |

Retail sales Marketplace sales included towards the threshold for individual sellers |

Next transaction |

|

| Florida | July 1, 2021* *Affected sellers not previously registered are relieved of tax liability, penalty, and interest due on remote sales that occurred before July 1, 2021 as long as they register by September 30, 2021 |

$100,000 |

Previous calendar year |

Taxable sales Marketplace sales excluded from the threshold for individual sellers |

First of calendar year after you meet the threshold |

|

| Georgia | January 1, 2019 January 1, 2020 |

$250,000 or 200 or more sales (effective January 1, 2019 through January 1, 2020) $100,000 or 200 or more sales* *Georgia enacted legislation in April 2019 that lowered the sales threshold to $100,000, but kept the 200 transactions threshold unchanged, effective January 1, 2020. |

Previous or current calendar year |

Retail sales of tangible personal property delivered electronically or physically, whether taxable or exempt Marketplace sales excluded from the threshold for individual sellers |

Next Transaction after meeting the threshold |

|

| Hawaii | July 1, 2018 and applies to taxable years beginning after December 1, 2017 |

$100,000 or more or 200 or more separate transactions |

Current or immediately preceding calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

The first of the month following when the threshold is met. |

|

| Idaho | June 1, 2019 |

$100,000 |

Previous or current calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

Next transaction (state doesn’t specify) |

|

| Illinois | October 1, 2018 |

$100,000 or more or 200 or more separate transactions |

Preceding 12-month period |

Retail sales Marketplace sales excluded from the threshold for individual sellers |

The retailer shall determine on a quarterly basis whether they meet the criteria for the preceding 12-month period |

|

| Indiana | October 1, 2018 |

$100,000 *Indiana removed its 200 transactions threshold, effective January 1, 2024. |

The calendar year in which the retail transaction is made or for the calendar year preceding the calendar year in which the retail transaction is made. |

Gross sales Marketplace sales excluded from the threshold for individual sellers |

Next Transaction after meeting the threshold |

|

| Iowa | January 1, 2019 |

$100,000 – effective July 1, 2019* $100,000 or 200 or more separate transactions prior to July 1, 2019 *Iowa removed its 200 transactions threshold on May 3, 2019. Effective July 1, 2019, only the $100,000 threshold applies to remote sellers, marketplace facilitators, and referrers. |

Current or immediately preceding calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

The first day of the next calendar month that starts at least 30 days from the day the remote seller first exceeded the threshold |

|

| Kansas | July 1, 2021* * The Kansas DOR released a notice on August 1, 2019 stating that any remote seller that sells tangible personal property or services into the state must register and begin collecting tax by October 1, 2019. The state did not specify a sales or transactions threshold. Kansas has since passed economic nexus legislation, effective July 1, 2021. |

$100,000 |

Current or immediately preceding calendar year* *Only for calendar year 2021 sales since January 1, 2021 |

Gross sales* Marketplace sales included towards the threshold for individual sellers *For marketplace facilitators, it is taxable instead of gross per Notice 21-14. |

Next transaction |

|

| Kentucky | October 1, 2018 |

$100,000 or 200 or more separate transactions |

Previous or current calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

First of the month following 30 days after the threshold is met (60 days eff. 7/1/2021) |

|

| Louisiana | July 1, 2020 |

$100,000 * Louisiana transaction threshold dropped as of August 1, 2023 |

Previous or current calendar year |

Retailsales Marketplace sales excluded from the threshold for individual sellers |

Within 30 days of exceeding the threshold, the remote seller must submit an application to the Louisiana Remote Seller Commission and must begin collecting state and local sales and use tax based upon actual applicable bases and rates on sales for delivery into Louisiana within 60 days. |

|

| Maine | July 1, 2018 |

$100,000* or 200 transactions *Maine enacted legislation on June 11, 2021 to remove the 200 transaction count threshold from the state’s economic nexus rules for remote sellers effective January 1, 2022. |

Previous or current calendar year |

Gross sales Marketplace sales excluded from the threshold for individual sellers and don’t include marketplace sales on return if reported by marketplace |

First day of the first month that begins at least thirty days after the seller has exceeded the threshold. |

|

| Maryland | October 1, 2018 |

$100,000 or 200 or more separate transactions |

Previous or current calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

First day of the month following when threshold is met |

|

| Massachusetts | October 1, 2017 October 1, 2019 |

$500,000 and 100 or more transactions $100,000* *Massachusetts enacted legislation on August 1, 2019 to change it’s thresholds. Effective October 1, 2019, the threshold will be $100,000 and no transaction threshold. |

Previous or current calendar year |

Gross sales Marketplace sales excluded towards the threshold for individual sellers if the marketplace facilitator is collecting |

First day of the first month that starts two months after the month in which the remote retailer first exceeded the $100,000 threshold, in the first year that it exceeds the threshold |

|

| Michigan | October 1, 2018 |

$100,000 or 200 or more separate transactions |

Previous calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

January 1 following the year the threshold is exceeded |

|

| Minnesota | October 1, 2018 October 1, 2019 |

$100,000 and 10 sales or 100 transactions $100,000 or 200 or more retail sales* *Minnesota has changed its thresholds. Effective October 1, 2019, the thresholds will be $100,000 or 200 transactions. |

The twelve-month period ending on the last day of the most recently completed calendar quarter |

Retail sales Marketplace sales included towards the threshold for individual sellers |

First day of the calendar month occurring no later than 60 days after meeting or exceeding the threshold |

|

| Mississippi | September 1, 2018 |

More than $250,000 |

Prior twelve-month period |

Gross sales Marketplace sales excluded from the threshold for individual sellers |

Next transaction |

|

| Missouri | 1/1/2023 |

$100,000 |

Previous twelve-month period reviewed quarterly |

Taxable sales of tangible personal property – including marketplace sales |

No later than 3 months following the close of the quarter when threshold was exceded |

|

| Montana | N/A |

N/A |

N/A |

N/A |

N/A |

No sales tax |

| Nebraska | January 1, 2019 (administrative announcement) April 1, 2019 (enacted legislation) |

$100,000 or 200 or more separate transactions |

Previous or current calendar year |

Retail sales Marketplace sales included towards the threshold for individual sellers |

The first day of the second calendar month after the threshold was exceeded |

|

| Nevada | November 1, 2018 |

$100,000 or 200 or more separate transactions |

Previous or current calendar year |

Retail sales Marketplace sales included towards the threshold for individual sellers |

By the first day of the calendar month that begins at least 30 calendar days after they hit the threshold |

|

| New Hampshire | N/A |

N/A |

N/A |

N/A |

N/A |

No sales tax |

| New Jersey | November 1, 2018 |

$100,000 or 200 or more separate transactions |

Previous or current calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

Required to collect on first taxable sale, 30 day grace period to register |

|

| New Mexico | July 1, 2019 |

$100,000 |

Previous calendar year |

Taxable sales Marketplace sales excluded from the threshold for individual sellers |

January 1 following the year the threshold is exceeded |

|

| New York | June 21, 2018, the date of the Wayfair decision |

$500,000 in sales of tangible personal property and more than 100 sales* *New York raised its economic nexus threshold from $300,000 to $500,000 on June 24, 2019. The number of transactions thresholds remains the same at 100 sales. |

Immediately preceding four sales tax quarters |

Gross receipts from sales of tangible personal property Marketplace sales included towards the threshold for individual sellers |

Register within 30 days after meeting the threshold and begin to collect tax 20 days thereafter |

|

| North Carolina | November 1, 2018 |

$100,000 or 200 or more separate transactions* *North Carolina removed its economic nexus threshold for marketplace facilitators, effective July 1, 2020. |

Previous or current calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

Next transaction* *Update based on the 2021 SST Disclosed Practice 8 submitted by the state; this has changed from 60 days to next transaction |

|

| North Dakota | October 1, 2018 |

$100,000* *North Dakota removed its 200 transactions threshold effective for tax years beginning after December 31, 2018. |

Previous or current calendar year |

Taxable sales Marketplace sales excluded from the threshold for individual sellers |

The following calendar year or 60 days after the threshold is met, whichever is earlier |

|

| Ohio | January 1, 2018 August 1, 2019 |

$500,000 $100,000 or 200 or more separate transactions* *Ohio lowered its threshold from $500,000 to $100,000 or 200 transactions effective August 1, 2019. |

Previous or current calendar year |

Retail* sales Marketplace sales included towards the threshold for individual sellers *Clarification and update based on the 2021 SST Disclosed Practice 8 submitted by the state |

Next day after meeting the threshold |

|

| Oklahoma | November 1, 2019 |

$100,000 in aggregate sales of TPP |

Preceding or current calendar year |

Taxable sales Marketplace sales excluded from the threshold for individual sellers |

The first calendar month following the month when the threshold is met |

|

| Oregon | N/A |

N/A |

N/A |

N/A |

N/A |

No sales tax |

| Pennsylvania | April 1, 2018 for collection or notice and reporting option July 1, 2019 |

$10,000 or comply with the notice and reporting requirements $100,000 |

Previous 12-month period Prior calendar year and then starting in the 2nd quarter – collection period 7/1/19 through 3/31/20 using CY 2018; and then collection period 4/1/20-3/31/21 using calendar year 2019 |

Taxable sales Gross sales on all channels including taxable, exempt, and marketplace sales |

Notice: On or before June 1 of each calendar year Mandatory economic: April 1 following the calendar year when threshold was exceeded |

Pennsylvania Notice & Reporting > |

| Puerto Rico | January 1, 2021 |

$100,000 or 200 or more separate transactions |

Seller’s accounting/fiscal year |

Gross sales Marketplace sales excluded from the threshold for individual sellers |

Next transaction |

|

| Rhode Island | August 17, 2017 – register or comply with notice (through June 30, 2019); July 1, 2019 – mandatory registration |

$100,000 or 200 or more separate transactions |

Immediately preceding calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

January 1 following the year the threshold is exceeded |

|

| South Carolina | November 1, 2018 |

$100,000 |

Previous or current calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

The first day of the second calendar month after economic nexus is established |

|

| South Dakota | November 1, 2018 |

$100,000 or 200 or more separate transactions * South Dakota transaction threshold dropped as of July 1, 2023 |

Previous or current calendar year |

Gross revenue Marketplace sales included towards the threshold for individual sellers |

Next transaction |

|

| Tennessee | October 1, 2019 |

$500,000* $100,000 starting October 1, 2020** *Tennessee enacted legislation on May 21, 2019 that authorizes the DOR to enforce its economic nexus rule, effective July 1, 2019. However, the state will not require out-of-state sellers to collect tax until October 1, 2019. **Tennessee passed legislation that lowers the economic nexus threshold from $500,000 to $100,000, effective October 1, 2020. |

Previous 12-month period |

Retail sales Marketplace sales excluded from the threshold for individual sellers effective October 1, 2020 |

The first day of the third month following the month in which the dealer met the threshold, but no earlier than July 1, 2017 |

|

| Texas | October 1, 2019 |

$500,000 |

Preceding twelve calendar months |

Gross revenue: including taxable, nontaxable, and tax-exempt sales Marketplace sales included towards the threshold for individual sellers |

The first day of the fourth month after the month in which the seller exceeded the safe harbor threshold |

|

| Utah | January 1, 2019 |

$100,000 or 200 or more separate transactions |

Previous or current calendar year |

Gross sales Marketplace sales excluded from the threshold for individual sellers |

Next transaction (state doesn’t specify) |

|

| Vermont | July 1, 2018 |

$100,000 or 200 or more separate transactions |

Prior four calendar quarters |

Gross sales Marketplace sales included towards the threshold for individual sellers |

First of the month after 30 days from the end of the quarter that you exceed the threshold |

|

| Virginia | July 1, 2019 |

$100,000 or 200 or more separate transactions |

Previous or current calendar year |

Retail sales Marketplace sales excluded from the threshold for individual sellers |

Next transaction (state doesn’t specify) |

|

| Washington | January 1, 2018 for collection or notice and reporting option October 1, 2018 |

$10,000 or comply with the notice and reporting requirements Gross income of the business exceeding $100,000* *October 1, 2018 through December 31, 2019, sellers with 200 or more separate transactions into Washington must collect. However, effective March 14, 2019 the threshold will only be $100,000. The state removed the 200 transactions threshold. |

Current or preceding calendar year Current or preceding calendar year |

Retail sales Gross sales* Marketplace sales included towards the threshold for individual sellers *October 1, 2018 through December 31, 2019, Washington used a retail sales standard. Effective January 1, 2020 it became a gross income standard. |

The first day of the month that starts at least 30 days after you meet the threshold The first day of the month that starts at least 30 days after you meet the threshold |

Washington Notice & Reporting > |

| West Virginia | January 1, 2019 |

$100,000 or 200 or more separate transactions |

Preceding or current calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers |

Next transaction (state doesn’t specify) |

|

| Wisconsin | October 1, 2018 |

$100,000* *Wisconsin removed its 200 transactions threshold effective February 20, 2021. |

Previous or current calendar year |

Gross sales Marketplace sales included towards the threshold for individual sellers – but if all sales are made through a marketplace that is collecting, the individual seller is not required to register |

Next transaction |

|

| Wyoming | February 1, 2019 |

$100,000 or 200 or more separate transactions *Wyoming enacted legislation that removed the number of transactions threshold as of July 1, 2024. |

Previous or current calendar year |

Gross sales Marketplace sales excluded from the threshold for individual sellers |

Next transaction |

“It has been extremely frustrating because the rules/laws are different in every state and our specific business and industry means we have to register in a state for a single sale and report on a monthly basis even though we only collected tax for the single sale.” – Dawndy Hancy, Abel, LLC

Another scenario that has thrown many a seller for a loop is what to do when 100% of your sales are exempt because you sell 100% for resale or only offer services that are exempt. Post-Wayfair, some states say you still need to register and file even if you only make exempt sales. Diane sees this as an inconsistency in policy, “Before Wayfair, if 100% of your sales are exempt, you didn’t register unless you needed to be able to give a resale certificate or there was a risk a customer couldn’t provide an exemption certificate” she says. Businesses need to evaluate why their sales are exempt and what is the risk for not being registered. And of course, they need to monitor law changes if the reason is their products or services are exempt. We are seeing states broadening their tax base which could result in a requirement to registered. This just happened in Maryland with the taxation of digital goods and electronically delivered software.

What’s the reward of hurdling all these challenges and staying compliant? An obvious reward is that you stay out of audit trouble and avoid any costly penalties and interest. A less obvious one is that should the day come you want to sell your business or involve investors or file for an IPO, you must make representations and warranties about compliance with the law to your buyer – and that includes sales tax law.

As an M&A attorney, Rochelle Friedman Walk has seen several deals fall apart over sales tax liability. Businesses that haven’t figured out post-Wayfair sales tax compliance cannot indemnify the buyer from all risks and liabilities with sales tax. If you mismanage your economic nexus requirements before the time of sale, Rochelle believes that in some cases the risk may be so large it’s better for the company to shut down than to sell or to figure out compliance and attempt to sell at a later date.

Rochelle Walk on the importance of compliance for businesses – especially if you plan to sell your business.

What’s Next for Nexus?

As the dust begins to settle in the post-Wayfair landscape, what’s next for tax nexus? According to Diane and Rochelle, out-of-state sellers can expect broader requirements for state income tax. The Multistate Tax Commission has already begun discussions to abolish federal Public Law 86-272 that prohibits states from imposing a state income tax on out-of-state businesses that only have mere solicitation activities within the states. States will want to pursue sellers for state income tax if they can and this will add another layer of compliance complications for sellers. For many marketplace sellers, the presence of their inventory in a state violates the protections of PL 86-272 which requires the filing of income tax. Given many of these sellers are considered pass-through entities, this results in a filing requirement for not just the entity but also the partners, shareholders or members of the entity.

Another trend expected to gain momentum is the expansion of economic nexus concepts globally. A number of nexus-related changes are coming to Canada and the European Union on July 1, 2021. Today, around five percent of our survey respondents are focusing on getting compliant globally and will have to closely monitor how their sales are taxed abroad in light of these changes.

Diane, Jordan, Rochelle, and Cameron share what’s on the horizon for nexus.

While some U.S. businesses shift focus to foreign tax obligations, foreign companies are only just beginning to do the same for U.S. sales tax obligations. Three years post-Wayfair, Diane believes we are only in the first inning when it comes to foreign companies selling into the U.S. understanding their economic nexus footprint and registering with states to collect and remit tax.

The Three-Year Recap

One day three years ago changed the course of sales tax in the U.S. forever. No matter what type of seller you are or industry you are in, you need to understand how economic nexus affects your business. It’s the law of the land and principles of it are likely to be adapted to other tax types soon!

Sales tax compliance affects the overall health of your business by limiting financial impacts from audits and avoiding any unwanted sales tax liability surprises should you decide to sell your business one day.

And one final reminder: physical presence is still the first test for sales tax obligations in a state! The Wayfair decision did not change this. If you have physical presence in a state through people, property, or certain activities, you probably need to register and the economic nexus thresholds do not apply to you.

If you need help navigating economic nexus, make sure to check out the resources below. If you need personalized assistance to evaluate your obligations, we offer a Wayfair Risk Analysis that might be just the right thing for you.

Interested in the rest of the survey results? Want to be sent the rest of the Three Years of Wayfair series?Click the button below to download a PDF version of our Three Years of South Dakota v. Wayfair survey. You’ll find insight into the impact of the decision on businesses registration efforts, marketplace obligations, audit requests, software and staffing requirements. You’ll also be added to a list to be sent Parts 2-5 (on the cost of compliance on businesses, local tax issues, audit trends, and marketplace nexus) of our Three Years of Wayfair blog series. |