All-Access Webinar Pass

All-Access webinar pass allows students to take 12 months of live webinars and access the full catalog of on-demand webinars at a fraction of the cost.

Sales tax professionals can often feel like the bearers of bad news for their clients or companies, but it’s certainly not all doom and gloom. Exemptions are one of the areas where you can be the bearer of good news!

Finding exemptions that are not being taken advantage of could save your client or company serious money. For this reason, knowing which sales tax exemptions are available in the states where you do business is absolutely crucial, and dare we say, fun!

In this blog post, we’ll explore some of the different types of exemptions that states offer for specific industries and types of use. Historically, these exemptions have been granted to encourage investment in the state by various industries.

Different states offer different exemptions, so always make sure to consult the tax statutes for a specific state or contact their Department of Revenue to see what exemptions are available.

One of the more common exemptions that you’ll see in many states is an exemption for manufacturing. Some states offer an exemption for machinery and equipment used to manufacture items of tangible personal property for sale.

The definition of manufacturing varies from state to state, and is rarely defined in the same manner as the taxpayer typically defines manufacturing. For this reason, you’ll want to consult the state’s tax statutes to confirm that the activity in question is considered “manufacturing.”

The typical definition covers from the point in the process where there is a material or chemical change to the raw ingredients and ends when the item is packaged and ready for sale. So this typically excludes functions such as receiving, storage, inventory management, maintenance, and shipping. But don’t just assume as there are some states that have very broad exemptions where some of these may be included!

The definition of equipment can also vary for purposes of a manufacturing exemption. Some states include chemicals, consumable materials, and other property not normally considered to be “equipment” in their definitions.

State manufacturing exemptions can be surprisingly broad and may apply to the following:

For example, in Texas, “manufacturing” includes a deli or bakery in a grocery store if they are processing the food. How’s that for a hidden gem?!? It goes to show that it can really pay off to go that extra mile and examine state statutes for hidden exemptions that your company may be missing out on.

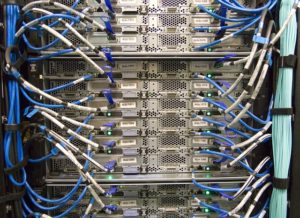

High tech exemptions are found in states that are interested in attracting more “clean” industry and higher priced jobs to their states. The high tech exemption typically applies to equipment (and often building materials) used to establish high tech service centers such as server farms or developers.

In Georgia, a high technology company’s purchases or leases of computer equipment for operational use in Georgia are exempt from sales and use taxes, if the amount of the computer equipment being purchased or the fair market value of the computer equipment being leased exceeds $15 million in a calendar year.

For purposes of Georgia’s high tech exemption, a high technology company includes, but is not limited to, a company that is engaged in:

That covers a pretty diverse range of industries and companies that can potentially reap huge cost savings on their purchases of computer equipment.

Call center exemptions came about as companies grew their customer support and call center functions as a way to keep jobs from going off-shore. These exemptions typically cover telecommunications services used in a call center but might also include some construction or facility exemptions and equipment. There are also often jobs credits available.

In Ohio, sales of telecommunications services that are used directly and primarily to perform the functions of a call center are exempt. For purposes of Ohio’s exemption, a “call center” is a physical location where telephone calls are placed or received in high volume for the purpose of making sales, marketing, customer service, technical support, or other specialized business activity. The call center must employ at least 50 individuals that engage in call center activities on a full-time basis, or sufficient individuals to fill 50 full-time equivalent positions.

Tennessee provides an exemption for interstate and international telecommunications services sold for use in the operation of a “call center.” For purposes of the exemption, “call center” means a single location that uses telecommunications services in one or more of the following activities:

To qualify for Tennessee’s exemption, the call center must have at least 250 employees engaged primarily in such activities.

If your business has some centralized purchasing of assets or supplies, you’ll want to look for a state that has a temporary storage exemption. Some states exclude from their definition of use, property which is stored in the jurisdiction temporarily before shipment outside the jurisdiction. This exclusion is often embedded in the state’s definition of use and may not be listed separately as an exemption. You may need to examine a state’s tax statutes closely when looking for this exclusion.

Some states limit the time that the goods can be stored in the state in order for the exemption to apply and others may limit it only to goods entering the state from outside the state. In Arizona for example, the exemption for temporary storage only exists if the property enters the state from outside the state and is governed by the Use Tax Statute.

In order for the temporary storage exemption to apply, usually there can be no use of the property prior to its shipment outside the state. Some states allow repackaging, testing, or other incidental use. Other states will view these actions as use and subject the property to tax.

If you do utilize a temporary storage exemption, remember to self-assess the use tax on the value of the property in the state where the property is ultimately used. Keep in mind this is a way to avoid paying tax in the first state where the property was received. This doesn’t mean it never has tax due. And the temporary storage exemption isn’t for items you are reselling. You’ll claim the resale exemption for those types of purchases.

Yes! These are just a few examples of activities that may qualify for exemptions across the states. Exemptions for agricultural, spaceport, movie and film production, and warehousing are some others that you might see in any given state.

Researching and finding exemptions is one of the fun activities sales tax pros have the opportunity to partake in, so start searching! You might be surprised at what you can find if you look closely at the state laws.

About the Author:

About the Author:Diane L. Yetter is a strategist, advisor, speaker, and author in the field of sales and use tax. She is president and founder of YETTER Tax and founder of the Sales Tax Institute. You can find Diane on LinkedIn and Twitter.