Remote Seller Nexus Chart

This remote seller nexus chart lists the states that have passed one or more types of legislation regarding nexus.

In the Internet age, the ability to make online sales is king. No matter if you’re a traditional brick and mortar store that decides to expand into online sales or a new ecommerce business, online sales offer an immense opportunity to reach new customers and grow your business.

However, adding a new online sales channel will require some system and operational changes. You may need to enhance your website, change your marketing strategy, or hire new personnel. One potentially overlooked aspect of broadening your customer base that cannot be ignored is the impact on your sales tax obligations.

When your company delves into the world of online sales, there are four key things you need to sort out to be in tip top shape for sales tax compliance. Let’s dig into each one.

The number of states you sell to will likely grow as you make online sales. You must pay attention to each new state’s sales tax nexus laws to understand if you are required to collect tax on your online sales.

Most states now have economic nexus laws that require sellers whose sales revenue or number of transactions exceed certain economic thresholds to register to collect tax.

For example, in Maryland, if you exceed $100,000 or 200 or more separate transactions in gross sales into Maryland in the previous or current calendar year, you must register to collect tax on those sales by the first day of the month following the date you exceeded either threshold.

For a summary of each state’s economic nexus rules, visit our Economic Nexus State Guide.

Economic nexus is the new reality for sales tax and a major concern for online sellers. You must carefully monitor your sales revenue and number of transactions into each state and keep track of each state’s variation on economic nexus so you can register to collect tax as necessary.

Online sales will require online shopping cart infrastructure on your company’s website. An effective shopping cart must include a sales tax solution at checkout that ensures compliance. To find the shopping cart that best meets the needs of your company, you will have to make a series of evaluations. Below are a few questions to consider. You may need a custom shopping cart built or a canned solution may suffice depending on the outcome of these questions and the needs of your business.

The ability to calculate tax within the shopping cart is critical. Some shopping carts can be integrated with your company’s existing tax engine. Others may have very limited tax functionality and may not integrate to a tax engine. Limited tax functionality and no integration may work for your company depending on what you sell. However, it could be troublesome if you sell items that have different tax rules in some states. Figure this out in advance before you commit to a shopping cart that might not work.

If you plan to sell outside the U.S., it will be important that your shopping cart can handle non-U.S. tax such as VAT or Canadian GST, international shipping, currencies, and more.

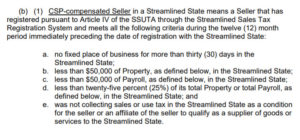

If you have nexus in multiple Streamlined Sales Tax member states due to new online sales, you may decide to register through the Streamlined Sales Tax Registrations System. If you register through Streamlined and qualify as a “CSP-compensated seller” (see full definition below) in a Streamlined Member state, that member state will compensate a Certified Service Provider (CSP) such as Accurate Tax, Avalara, Sovos , or TaxCloud to provide you tax software and services at no charge.

Source: Streamlined Sales Tax

This major benefit of Streamlined can help you get set-up to automate sales tax in your shopping cart with the help of one of the major tax software providers. But to our earlier point about knowing what capabilities your shopping cart offers, if you can’t use one of the CSP tax engines, then you can’t take advantage of this benefit.

Certain online shopping cart integrations give you the ability to capture and obtain exemption certificates at checkout. If you sell to a lot of exempt customers, you may need to determine whether you want to collect exemption certificates for each order or have customer accounts where the certificate is applied to the account. Choose a shopping cart that supports your business requirement.

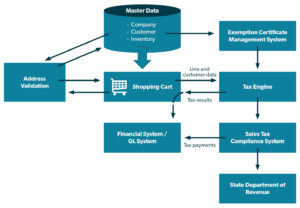

Address validation is perhaps the most important feature of an online shopping cart which is why it’s worth discussing separately. No matter what you sell, you must determine how to capture and validate addresses so you can charge the correct amount of tax every time. Not to mention have a successful delivery to your customer!

Most states use destination-based sourcing for sales tax collection. This means that as the seller, you will charge sales tax based on your customer’s ship-to address. Your tax calculation function must include the state rate and local jurisdiction rates such as at the city or county level.

Capturing addresses when you sell tangible goods seems intuitive – you need to know where to ship the purchased goods. But what about digital goods? You still need to identify the correct taxing jurisdiction on sales of digital goods. Tax should be based on user location. Tax calculation usually defaults to using the billing address if you don’t have the ability to ask for user location in the shopping cart. If you require the user to “register” and provide their location, then you will need to tax based on this address.

With exempt customers comes document and information management. If you anticipate that you’ll sell to a lot of exempt customers on your new online channel, you must decide if you will make those sales exempt on the order or make your customers pay sales tax on their orders and request a tax refund.

If you decide to make sales exempt on the order, you need to either require your customers to set up accounts with you to which you can apply their exemption certificate to each subsequent order or require your customers to submit an exemption certificate with every order. Consider how much repeat business you typically have vs. one-time orders in this decision.

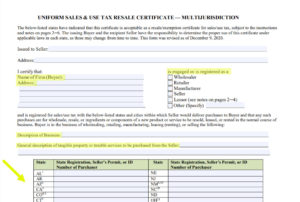

Highlights of key information you will need to gather for exempt customers using MTC form as example.

Source: MTC Multijurisdictional Uniform Sales & Use Tax Resale Certificate

Orders with exemption certificates need to be validated. Will you put orders with exemption certificates on hold until you approve them? Or will you implement a system that auto-approves the certificates? Auto-approval runs the risk that an exemption certificate contains invalid or incorrect information and tax might not be collected on that order.

The type of customer-based exemptions you handle will help you make these decisions. If your customer exemptions are predominantly due to exempt entities (schools, churches, not for profits, government), the rules can be very specific, and it might be harder to assume your customer really does qualify. However, if the exemptions are for resale, and the nature of what you sell is typically bought to be resold, it might be easier to have some automated approval processes.

When sales tax implications are considered before expanding your business to a new sales channel like online sales, you save a whole lot of potentially costly headaches down the road.

If you manage sales tax for your company, you should advocate to be involved in the early stages of planning. You’ll want to have a clear plan in place (that includes the four points above!) that outlines your company’s sales tax obligations at each step of the product journey – from your supplier to your end customer.

There are so many sales tax factors to consider when something new starts in your business, starting with your nexus evaluation and how to register for sales tax to obtaining exemption certificates to figuring out how to calculate sales tax, and so much more.

If you want an in-depth tutorial of how to handle the process of starting a new business (or channel, like online sales) from a sales tax perspective, check out our on-demand webinar: Starting a New Business or Initiative: What You Need to Know for Sales Tax.