The Internet of Things: What Is It and How Should It Be Taxed?

One of the big themes we’ve seen in the world of sales and use tax over the last decade or so has been the emergence of new and never-before-seen industries, products and services and the attendant rush for states and tax professionals to figure out how exactly to tax them. It can be terribly frustrating for sellers, purchasers and tax practitioners to figure out how to classify these items so we can assign them the proper tax status. Not to mention that each state can choose to classify and tax them differently.

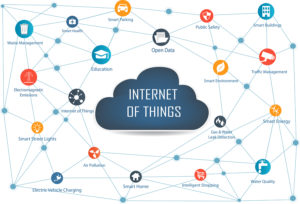

It is within this rapidly changing environment that we’ve seen the emergence of the Internet of Things. What is the Internet of Things (IoT), exactly? Good question – it can be a bit difficult to define, but it can be summed up as a network of “intelligent,” connected devices that generate data for automating business processes and enabling new services. Still not clear? Let’s look at a few real-world examples you may be familiar with.

Do you wear a Fitbit or an Apple Watch on your wrist? Do you have an Amazon Echo in your home? If so, you are already taking advantage of the IoT. Other examples include smart home devices such as Nest and even security systems. But the implications of IoT go far beyond personal and home devices.

As mentioned above, IoT can be used to automate business processes and enable new services. This means that it can affect any number of industries including manufacturing, healthcare, energy and resources, transportation and many more. In other words, IoT is a big deal with big ramifications for virtually everyone.

And this is the very reason that we as tax professionals, consultants and business owners should be taking it seriously. This new world of intelligent, connected devices is here to stay. So now is the time to start talking about how these items should be classified for sales and use tax purposes. Not doing so could lead to some very costly errors down the line.

So what are the tax complications that arise with IoT? Well, they are numerous, but let’s look at the big one. For items that fall under the umbrella of IoT – items that may include nebulously defined products and services, items where the line between product and service can be blurred – how do we classify them for sales and use tax? Are they tangible personal property, intangible personal property, or services?

Naturally, the states have something to say about that. And they can characterize these items into any of the following categories:

- A sale, rental or access to prewritten software

- An enumerated service (“cloud” or Application Service Providers)

- Data processing

- Data storage service

- “Digital automated service”

- “Canned” information services

- Personalized information services

- Communications service

- Or even just tangible personal property

A little scary, right? If you sell or purchase these products, how do you know that they are being characterized and taxed correctly? Given the differing treatments among the states, that could be very difficult to ascertain. Not to mention – and this is a big one – many states haven’t yet issued guidance on how to tax the IoT. When you realize the many different directions that this can take, it can be very stressful from a tax perspective.

About the Author:

About the Author: