Top 3 Reasons to Participate in Streamlined Sales Tax

The Streamlined Sales Tax (SST) Project/Agreement is the result of cooperative efforts across the states to simplify sales and use tax collection and administration for taxpayers and states alike to create more uniform sales and use tax systems.

States that sign onto the agreement agree to make certain changes in their statutes and policies as necessary to comply with the agreement that reduces the burden of tax compliance for taxpayers like adopting uniform definitions and sourcing rules.

There are currently twenty-three full member states and one associate member. Given that navigating state by state differences in sales tax is a major difficulty, consistency in managing twenty-four at once is a win!

The SST Project provides a variety of other benefits to businesses beyond harmonizing sales tax rules across member states through its programs and tools. Most taxpayers don’t realize that many of these benefits are available to all taxpayers in the state – whether you use a Certified Service Provider (CSP) or not. What are these benefits you say? Let’s take a look at three of the most compelling.

1. Multistate Simplified Registration System

One of the biggest headaches in getting sales tax compliant is registering to collect and remit sales tax in the states where you do business. Each state’s registration process is different, with varying information you have to gather and hoops you have to jump through. The Streamlined Sales Tax Registration System can wipe much of that frustration away.

The Streamlined Sales Tax Registration System is a simple and free system you can use to register for sales and use tax in all or select SST member states with just one application. Any seller may register in new states using the system, even if you are already registered in one or more SST states. You can also use the system to end registration in selected states. For example, if you fall well below an economic nexus threshold in a state, you may be inclined to de-register.

After you register through the system, you will be issued a Streamlined Sales Tax ID (SSTID). You can use the SSTID for communications with Streamlined and all SST member states. Some states may allow you to use this for filing returns.

Another benefit of the consolidated registration system is that you can update your registration information for all SST states in which you are registered for through the SSTRS. For example, if you need to update your business address, you do that directly within the SSTRS and your update will be passed on to each state you are registered in. That in of itself is a HUGE timesaver for anyone that has moved and has had to make an address update in each unique state.

2. Certified Service Provider Offer Free Sales Tax Software Functions

As you take steps to register in new states, you must also simultaneously take steps to secure the right technology to collect the tax and manage the returns process once you are registered.

One of the major benefits of registering in Streamlined member states using the SSTRS is that you can qualify to use a Certified Service Provider (CSP). A CSP is an agent certified under the SST Agreement to perform all of a seller’s sales and use tax functions in Streamlined states at no cost to the seller. That’s right, at no cost!

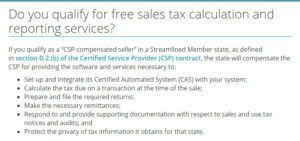

If you qualify as a “CSP-compensated seller” in an SST member state, the state will compensate the CSP for providing software and services to you to complete key sales tax tasks like calculating tax and filing returns.

Source: Streamlined Sales Tax

To qualify as a “CSP-compensated seller” and receive free services, there are some technicalities you must satisfy. You must register through the SSTRS, contract with a CSP for services as provided under the Streamlined contract, and meet certain property and payroll limitations as well as other criteria during the 12 months prior to registration with that state.

There are currently four CSPs certified by the Streamlined Sales Tax Governing Board that offer free services: Avalara, TaxCloud, Sovos, and Accurate Tax.

A CSP may charge for services in states where you are not a “CSP-compensated seller,” states where you are not registered through the SSTRS, or for states that are not Streamlined member states.

3. Taxability Matrix

One overlooked tool provided by Streamlined that can help you manage sales tax is their Taxability Matrix. You can use this matrix to help you determine whether the products and services you buy and sell are taxable in the SST states.

The matrix has two sections. The first is a “Library of Definitions” that lists items defined in the SST Agreement and provides whether each state has adopted each definition and whether items are included/excluded from the sales price or taxable/exempt.

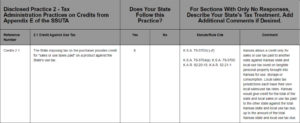

For example, here is the ‘mandatory computer software maintenance contracts’ section of the Kansas Taxability Matrix:

When you click into each state in the matrix, you will see how each state treats identified items for sales tax purposes along with the applicable law, rule, regulation, or policy so you know where to go for more information.

The second section of the matrix lists “Tax Administration Practices” that indicate which administrative practices each state follows, like crediting and sourcing practices, along with a citation and state comments.

You can use the Taxability Matrix “Compare Tool” to compare two versions of a state’s Taxability Matrix to see when taxability changes or new taxability rules were adopted.

Save yourself a lot of time searching and use the Taxability Matrix to find consolidated taxability information in a handy chart format and to keep up with key taxability changes in SST states. All of this information is for free – and the answers are provided by the state, which means you have protection if you rely on the answers. Just be sure you retain documentation of the matrix as you relied on it.

Why Does SST Matter Now?

Growing a business is rarely confined to a business’s home state anymore. Online sales broaden customer reach but also can have major sales tax implications over time in this post-Wayfair economic nexus environment.

All of the SST member states have adopted economic nexus rules for out-of-state sellers. Registering through the Streamlined system can ease the burden of tax compliance in SST states. Plus, it can help you avoid state registration fees and give you the option of using free certified sales tax software that takes care of calculation and filing for you.

No matter if you’re a remote seller whose sales tax requirements have ballooned post-Wayfair or an established seller already managing sales and use tax obligations in many states – many benefits of SST may be available to you.