Basics of Sales and Use Tax by the Numbers

After 30+ years in the sales tax field, I have asked hundreds of sales tax professionals how they got into sales tax. Some of the most common answers are along the lines of:

- “Someone pushed me into it!”

- “I’m a one-person tax department, it’s just part of the job.”

- “No one in my company wanted to do it, so I took it on.”

If this sounds like you, you might hold a little grudge against the person who nudged you into sales tax. Why? Because sales tax is complicated, in every sense of the word.

It is not easy to wrap your head around all the pieces that go into sales tax compliance for your company – especially early on in your career. Without guidance, handling sales tax can be frustrating and downright nerve wracking as the costs of noncompliance can be huge.

If you don’t have a solid foundation in sales and use tax concepts, how are you supposed to manage your work efficiently and accurately?

Let me offer a game-changer: Basics of Sales and Use Tax. Basics is our live in-person, 3-day training course designed for individuals with less than 4 years of sales and use tax experience.

We craft Basics to focus on the practical application of sales and use tax concepts. We want you to be able to apply what you learn to your job right away.

Simply put, our approach works – but you don’t have to take it from me. Valuable feedback from Basics alums demonstrates just how transformative this course can be.

Work Smarter, Faster, and More Accurately

David R. is one of the people who says they were “thrown” into sales and use tax. Before Basics, he had never attended a formal sales and use tax training but had already handled sales tax issues for his company for several years. The course helped David learn to better prioritize the sales tax challenges in his work.

Sales tax work is often a detailed puzzle. If you’re missing pieces, it can be hard to see the big picture and make decisions that move your company in the right direction. At Basics, Samantha P. developed a more robust foundation in sales tax. She went on to improve her company’s procedures so that her team can work easier and more accurately in the long run.

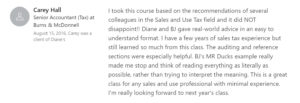

So many sales tax professionals learn on the job. That’s why we incorporate as many real-world examples into Basics as possible, so you can implement new knowledge into your workflow without having to learn by trial and error. Carey H. took our practical examples and ran with them. She discovered a more productive way to work so she can spend more time on the truly critical issues as she guides her department.

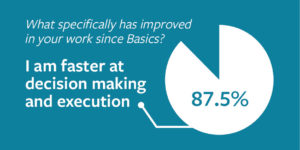

Time is of the essence in sales tax. You need solutions in your job today, not tomorrow. We surveyed Basics alums and found that Basics was a launching point to faster decisions making and execution in their jobs.

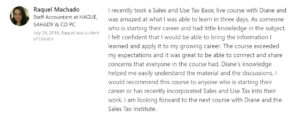

Speaking of time – our course is only three days. We aim to strike the right balance between addressing the challenges you already face and encouraging you to look towards the future in a short amount of time. Raquel M. grew in confidence during Basics and used her new knowledge and skills to open new doors in the accounting profession.

Sales Tax – it CAN be a Career

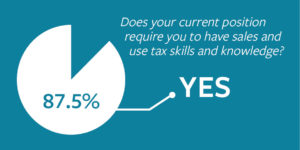

No matter how our alums initially found themselves in the field, something we’ve learned through the years is that Basics students stick with sales tax. Over 87% of people who took Basics in recent years are still working with sales tax today.

When Alex D. arrived at Basics, she had only been working with sales tax for about a year and half. The course was pivotal in helping her expand her sales tax tasks and see that she could take on a leadership role in her department. With the stress of concept mastery fading away, Basics opened her eyes to the possibility of a career in sales tax.

Linda P. was not new to sales tax when she came to Basics, but still found immense value in the sessions for taking her career to the next level. Since the course, Linda has used her growing sales tax expertise in leadership positions in multiple industries.

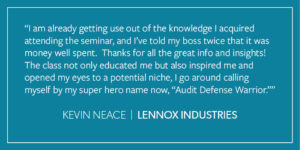

We love seeing our students get excited about all of the new ideas they will take back to their companies. But perhaps the most rewarding moments are those when students like Kevin N. decide to embrace the career possibilities in sales tax. As a result of his training at Basics, Kevin became an invaluable asset to his company as someone well-equipped to manage sales tax audits. He understands the immense value he can create in this niche area.

Whether you consider yourself a sales tax novice or more of a mid-level specialist, Basics can be just the kind of stepping stone you’re looking for to level up in your career. Half of recent Basics alums noted that the course helped them attain a promotion or a more specialized position in their company.

Tackling sales tax issues and compliance is not for the faint of heart. It is detail-oriented and skillful work – which can be a major source of frustration for professionals starting out. We strive to make Basics a course that meets the needs of both the person who was begrudgingly pushed into sales tax and the person who enjoys the specialty but needs a stronger foundation.

We meet you where you are, because we have witnessed the transformations that can take place after three days. We can’t promise that you’ll want to adopt an awesome sales-tax-themed nickname after Basics, but you will walk away with practical and actionable solutions for your day-to-day sales tax work.

About the Author:

About the Author: