South Dakota v. Wayfair Supreme Court Experience

By Diane Yetter

April – what a momentous month in the sales tax world! On the April 17, the Supreme Court heard oral arguments for the online sales tax dispute, South Dakota v. Wayfair, Inc. This case could determine whether states have the right to require tax collection from online merchants and other remote sellers with no physical presence in their states.

A case of this stature only comes about a few times in a career. The last time the high court heard a sales tax nexus case was in 1992, and I’ve seen and helped clients navigate so many changes in my field since then.

Some may call it nerdy, but since I live and breathe sales tax – I couldn’t miss out! I packed my bags and headed to our nation’s capital, so I could be in the courtroom on the most historic day in recent sales tax history.

The day before the oral arguments, I visited the Supreme Court to scope out where all the action would take place. I even ran into a friend, Matt Melinson while I was there! How to cool to see people I know from the tax community walking around D.C.

That evening was full of lively discussions with new and old friends that work in tax. Is there really anything better than discussing the fine points of a sales tax Supreme Court case over a glass of wine? It was such an enjoyable time debating the potential outcomes of the case and hearing such well-thought out opinions and predictions from fellow tax enthusiasts.

And then it was Tax Day (in more ways than one!). Do you think it was ironic that the Court scheduled this case on Tax Day? Many of us thought it was deliberate by the justices!

April 17 started very early for me. To secure a place in the courtroom for Supreme Court arguments, one must wait in line. And if you’re a member of the non-lawyer, general public like me it means you have to get in line as early as possible if you want a seat! Attorneys licensed to practice before the Supreme Court have their own line and some were in line as early as the public line! They are all guaranteed into the courthouse – some into the courtroom and the rest get to sit in the lawyer’s lounge and watch on closed circuit.

I had thought 6am would have been early enough – but then heard people were lining up at 5pm. So I thought – I need be there before then and planned for 4:30. It was a short walk from my hotel – which I had booked the day the Court announced they would hear the case. I wanted to be as close as possible.

I arrived at the Supreme court around 4:35am (when the temps were in the upper 30’s) and the line had already formed – some people were “professional line-standers” that had been there a good part of the night. I had talked to one of the guards the day before, so I knew that at 7:15, they hand out tickets to the first 50 people in line. So that was the goal. It was hard to get an exact count of where we were in line as those line-standers were buried under tarps and sleeping bags. When I counted – it looked like I wasn’t in the first 50 – but around 60-65. So, not guaranteed, but very optimistic!

The guard I chatted with on Monday was kind enough to answer all my questions about the process! The building would open at 7:30am – but those that weren’t in the first 50 wouldn’t know if they would get in until about 9:30. The hearing would start at 10. He said typically 75 to 100 members of the public get in – but if there are a lot of special guests with reserved tickets, that number could be lower. I had tried a number of avenues to find reserved tickets but I struck out. But knowing all the types of people that were interested, I was worried about this…

It was freezing outside, but the atmosphere was collegial, and you could tell there was excitement building – which made the cold a lot more bearable. Several good friends from Council on State Taxation and McDermott Will & Emery (who were in the attorney line) came over to visit the public line and handed out snacks, adding to the sense of community among all of us waiting for the case.

Standing in line for hours afforded me the time to get to know the people around me. I was particularly intrigued by what motivated the non-tax people to come wait in line at the Court for a sales tax case.

There was a small group of us that were together for those 5 and a half hours – I met Amol from RSM, John from National Association of State Budget Officers, Jeremy from Grant Thornton (who had gone on a coffee run when we snapped this pic!) and Michael – just a regular person who doesn’t work in tax but has wanted to see a Supreme Court argument and thought this one was interesting and would impact him personally.

We were pretty quiet when we first arrived – but gradually started chatting about our thoughts. Going in, it was a pretty common expectation that the Court wouldn’t have taken the case if they weren’t planning to do something – make a change. So, our focus was what might that look like and what might that mean for businesses. Would they strictly accept the South Dakota thresholds? Or would they say no physical standard is necessary at all? Hearing the perspective from John and State Budget Officers and the need for the revenue as well as from Michael, a consumer helped Amol, Jeremy, and I who all practice in the area get some insight.

My anticipation was building each time they moved us up in the line. A true human compassion story happened at 9:30 when they allowed the next group to go in. It was only 18 people and I was at about 25. But at #16 was a tax professional. Right after him was a family from California, a young girl of 11 who would like to be a Supreme Court justice and her parents. When the guard came, only 2 of the family would make it in. The tax professional (wish I had gotten his name) – surrendered his spot and let the family go in. We all decided he earned a place in tax heaven for doing that!

Unfortunately, in the end, I missed getting in for the entire arguments by seven people. But even further behind me in line was Adam Krupp, the Tax Commission from Indiana. We also chatted about the case – and took the time for a selfie! I couldn’t believe he didn’t have a coat or gloves – he was definitely cold!

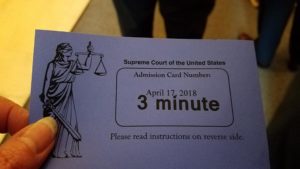

The last people to get in arrived around 4am – so I missed it by about 30 minutes! It was a major bummer to say the least. From my chat with the guard, I did know that a second line would form – to watch 3 minutes of the case. I wanted to at least see some of the case, so I moved to that line. My group got the first 3 minutes – and it did surprise me how quickly the justices interrupted! It was of course very cool, but I so wanted to hear it all.

If you want to read or listen to the full hour of arguments – here are the links:

→ Transcript

→ Audio

Luckily, the day was not a total loss after not getting in. I attended an oral argument roundtable discussion hosted by McDermott Will & Emery, Bloomberg Tax, and COST. The event gave a great historical overview of case, detailing what has happened since 1992, including reminders about the early days of Streamlined. We even got to see the case files from Quill Corp. v. North Dakota, the last Supreme Court sales tax case! McDermott represented Quill back in 1992! Then a great panel went through the different issues from the case (more to come on that in my next post).

What was very interesting was the change in expectation. The panel took a vote of what we thought before the arguments – about 80% of the attendees expected the Court to overturn Quill. But after the arguments, about 60% now thought Quill would be upheld! But you know what they say – don’t read too much into the Justices’ questions.

Even though I am still really disappointed I didn’t get to see the arguments first hand, it was still worth the trip to be able to share the overall experience with other people deeply invested in the outcome of the case. The court decision is expected to come out in June.

I’ll be writing up a more detailed analysis of the arguments and my thoughts, as well as sharing some of what others are saying. This really was a once in a lifetime experience and I wanted to share the “behind the scenes” experience with all of you! I hope you got a feel of what it was like – and maybe if you are in D.C. and the Court is in session, you’ll think about trying to get a seat in the courtroom!

About the Author:

About the Author: